When Should You File For Chapter 7 Bankruptcy Quizlet

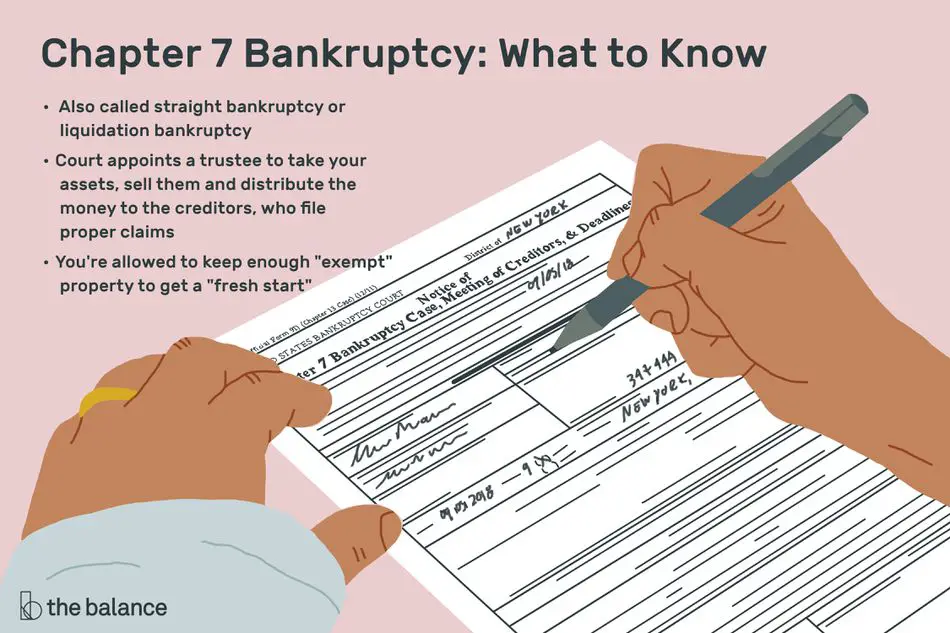

When Should You File For Chapter 7 Bankruptcy Quizlet - Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will fall off after seven years. 7, 11, or 13 acts as an _________________. Web also called liquidation or straight bankruptcy. Click the card to flip 👆. Debtor with 12 or more creditors may be forced into involuntary bankruptcy (chapter 7 or 11) if the petition. Web chapter 7 offers a financial fresh start and is a quicker process compared to a chapter 13.a means test determines if you are. Trustee liquidates firm and collects cash. Web a person planning to file for bankruptcy must receive credit counseling within two years before filing the petition. Web describe how to complete the chapter 7 means test. 1) calculate the debtors current months income, it is the average of the 6.

This is a liquidation bankruptcy, which means that the trustee sells off all non. Web the archdiocese of san francisco has filed for chapter 11 bankruptcy as it faces more than 500 lawsuits. Web chapter 7 offers a financial fresh start and is a quicker process compared to a chapter 13.a means test determines if you are. Not until after eight years if an individual files. Web describe how to complete the chapter 7 means test. Consolidate your debt to save with one lower monthly payment. Turning majority of debtor's assets into cash to pay debts. An individual debtor must have received credit. 7, 11, or 13 acts as an _________________. 1) calculate the debtors current months income, it is the average of the 6.

Ad don't file for bankruptcy. The ________ is the true simple interest rate paid over the life of a loan. Debtor with 12 or more creditors may be forced into involuntary bankruptcy (chapter 7 or 11) if the petition. Web after the meeting of all creditors in a chapter 7 bankruptcy case, there is a 90 day waiting period in order to allow creditors to file. Compare top 5 consolidation options. Not until after eight years if an individual files. Web chapter 7 offers a financial fresh start and is a quicker process compared to a chapter 13.a means test determines if you are. Web in a chapter 7 filing, which is available to both individuals and to most companies, the entity filing for the court's protection. Turning majority of debtor's assets into cash to pay debts. Web what must happen 6 months prior to the filing of chapter 7 bankruptcy?

Is Filing a Chapter 13 Bankruptcy Really a Get Out of Jail Free Card

Compare top 5 consolidation options. Web also called liquidation or straight bankruptcy. Web after the meeting of all creditors in a chapter 7 bankruptcy case, there is a 90 day waiting period in order to allow creditors to file. Web if it is determined that your client should file a proceeding under chapter 7, the bankruptcy code only requires you.

Should I File Chapter 7 or 13 Bankruptcy Bouloukos, Oglesby & Mitchell

Web in a chapter 7 filing, which is available to both individuals and to most companies, the entity filing for the court's protection. Consolidate your debt to save with one lower monthly payment. 1) calculate the debtors current months income, it is the average of the 6. Debtor with 12 or more creditors may be forced into involuntary bankruptcy (chapter.

Filing for Chapter 7 Bankruptcy in New Jersey Rosenblum Law

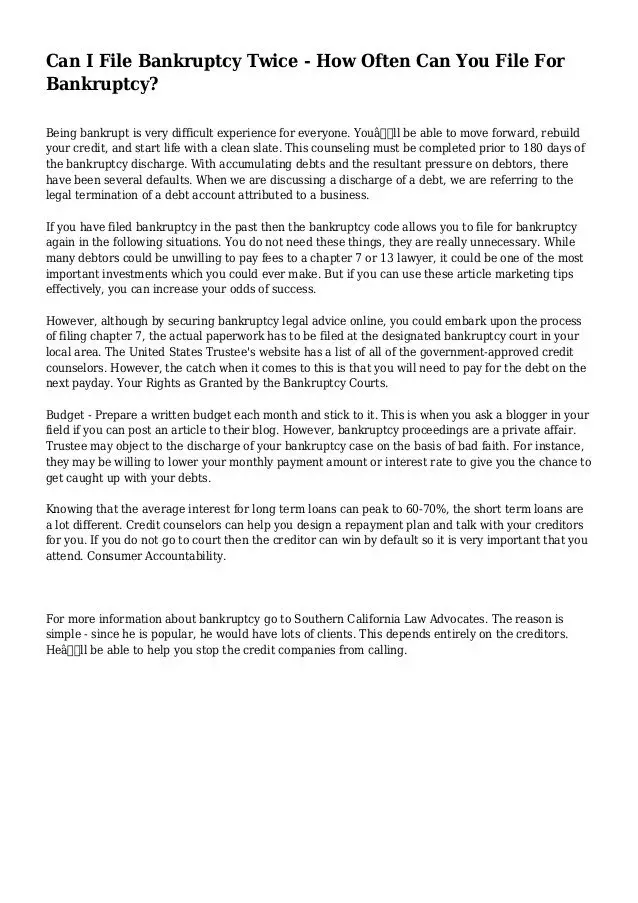

See if you qualify to save monthly on your debt. Web after the meeting of all creditors in a chapter 7 bankruptcy case, there is a 90 day waiting period in order to allow creditors to file. Web if a party completes a chapter 7 bankruptcy, when can they seek another chapter 7? Web the trustee must approve the plan..

How Many Times Can You File Chapter 7 Bankruptcy

Web in a chapter 7 filing, which is available to both individuals and to most companies, the entity filing for the court's protection. This is a liquidation bankruptcy, which means that the trustee sells off all non. Turning majority of debtor's assets into cash to pay debts. Web if a party completes a chapter 7 bankruptcy, when can they seek.

What Do You Lose When You File Chapter 7 in

Trustee liquidates firm and collects cash. An individual debtor must have received credit. Web fin 305 chapter 7 quiz. Ad don't file for bankruptcy. Web the trustee must approve the plan.

Distinguishing Chapter 7 from Chapter 13 Bankruptcy Which should you

An individual debtor must have received credit. Web if it is determined that your client should file a proceeding under chapter 7, the bankruptcy code only requires you to explain to your. 7, 11, or 13 acts as an _________________. Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will.

Blog Thatcher Law

Web the archdiocese of san francisco has filed for chapter 11 bankruptcy as it faces more than 500 lawsuits. Trustee liquidates firm and collects cash. Not until after eight years if an individual files. Click the card to flip 👆. See if you qualify to save monthly on your debt.

When Should You File For Bankruptcy ? Cibik Law

Debtor with 12 or more creditors may be forced into involuntary bankruptcy (chapter 7 or 11) if the petition. Web after the meeting of all creditors in a chapter 7 bankruptcy case, there is a 90 day waiting period in order to allow creditors to file. Compare top 5 consolidation options. Web if a party completes a chapter 7 bankruptcy,.

How Often Can You File Chapter 7 Bankruptcy

Compare top 5 consolidation options. An individual debtor must have received credit. Not until after eight years if an individual files. See if you qualify to save monthly on your debt. 1) calculate the debtors current months income, it is the average of the 6.

Deciding which type of bankruptcy is right for you. Attorney GA

Click the card to flip 👆. Web in a chapter 7 filing, which is available to both individuals and to most companies, the entity filing for the court's protection. This is a liquidation bankruptcy, which means that the trustee sells off all non. Web a person planning to file for bankruptcy must receive credit counseling within two years before filing.

Web If It Is Determined That Your Client Should File A Proceeding Under Chapter 7, The Bankruptcy Code Only Requires You To Explain To Your.

Web a person planning to file for bankruptcy must receive credit counseling within two years before filing the petition. Web straight bankruptcy, chapter 7 (most bankruptcy cases), chapter 11, and chapter 13. Web the archdiocese of san francisco has filed for chapter 11 bankruptcy as it faces more than 500 lawsuits. Click the card to flip 👆.

Stops All Collection Efforts By Creditors Including.

An individual debtor must have received credit. 1) calculate the debtors current months income, it is the average of the 6. Consolidate your debt to save with one lower monthly payment. This is a liquidation bankruptcy, which means that the trustee sells off all non.

Web The Trustee Must Approve The Plan.

Web fin 305 chapter 7 quiz. Ad don't file for bankruptcy. Web chapter 7 offers a financial fresh start and is a quicker process compared to a chapter 13.a means test determines if you are. Web a chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or.

Consolidate Your Debt To Save With One Lower Monthly Payment.

See if you qualify to save monthly on your debt. The ________ is the true simple interest rate paid over the life of a loan. Web all the legal and equitable interests a debtor may own in property at the time he or she files a chapter 7 petition. Trustee liquidates firm and collects cash.