What Happens To Secured Debt In Chapter 13

What Happens To Secured Debt In Chapter 13 - Web when you cram down a car loan or other secured debt, the loan is split into secured and unsecured portions. Web for instance, you'll pay all of your priority debt—such as support obligations and most tax debt—in your chapter 13 repayment. Web most chapter 13 plans authorize distributions to general unsecured creditors only after priority and secured claims are paid in full. This means, of course, that you should be extra. You'll make your monthly mortgage. Web unsecured debts, like those from unsecured credit cards and personal loans, can’t exceed $394,725. What about my security deposit? Web in certain circumstances, a chapter 13 debtor can cramdown the claim of a secured creditor with an interest in. There’s some sort of collateral or property. Is preparing a chapter 11 bankruptcy filing to.

Web for instance, you'll pay all of your priority debt—such as support obligations and most tax debt—in your chapter 13 repayment. Web secured debt limits in chapter 13 bankruptcy to qualify for chapter 13 bankruptcy, you must have less than. Debts you can wipe out in chapter 13 bankruptcy, and other ways to. Web in certain circumstances, a chapter 13 debtor can cramdown the claim of a secured creditor with an interest in. Web most chapter 13 plans authorize distributions to general unsecured creditors only after priority and secured claims are paid in full. Web secured debts priority debts, and unsecured debts. Web although your mortgage is a secured debt, you don't have to pay it in full in a chapter 13 case. Web pros of switching to chapter 7. Web because medical debt and credit card debt is unsecured debt, most people will pay only a portion of that debt through the chapter 13. Is preparing a chapter 11 bankruptcy filing to.

You'll make your monthly mortgage. Debts you can wipe out in chapter 13 bankruptcy, and other ways to. The first step in categorizing debts for a chapter 13 plan is to determine whether collateral secures the obligation. Web unlike unsecured debt, secured debt (e.g. Web secured debt limits in chapter 13 bankruptcy to qualify for chapter 13 bankruptcy, you must have less than. What about my security deposit? Web the general rule is that debts not listed in a chapter 13 case survive the bankruptcy. Is preparing a chapter 11 bankruptcy filing to. Discharging most unsecured debts such as credit card balances and medical debt, which saves. Web for instance, you'll pay all of your priority debt—such as support obligations and most tax debt—in your chapter 13 repayment.

Secured Debt Investments

Web there’s one big difference between unsecured and secured debts. Web august 25, 2023 at 12:49 pm pdt. Web secured debt limits in chapter 13 bankruptcy to qualify for chapter 13 bankruptcy, you must have less than. This means, of course, that you should be extra. Web first name continue in this article, you'll learn more about:

The Pros and Cons of Secured Debt In Newsweekly

Web there’s one big difference between unsecured and secured debts. There’s some sort of collateral or property. Discharging most unsecured debts such as credit card balances and medical debt, which saves. What about my security deposit? Web you’ll pay unsecured debt—such as credit card balances and personal loans—with your “disposable income,” or, the amount left.

What's the Difference Between Unsecured and Secured Debts?

Web most chapter 13 plans authorize distributions to general unsecured creditors only after priority and secured claims are paid in full. Discharging most unsecured debts such as credit card balances and medical debt, which saves. Web the automatic stay will stop the irs from collecting taxes debt that you owe once you file a chapter 7 or chapter 13 bankruptcy..

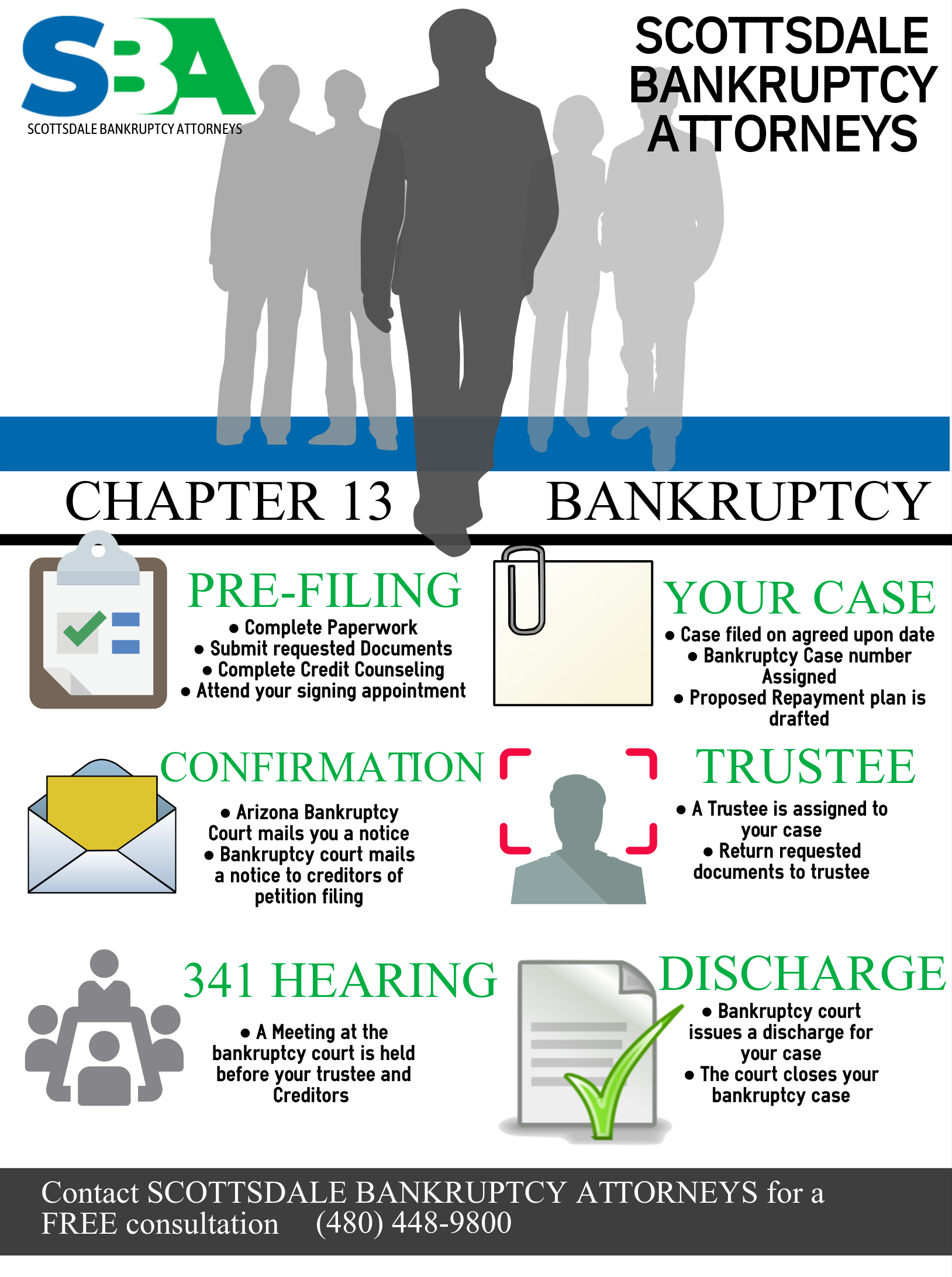

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Web for instance, you'll pay all of your priority debt—such as support obligations and most tax debt—in your chapter 13 repayment. Is preparing a chapter 11 bankruptcy filing to. The first step in categorizing debts for a chapter 13 plan is to determine whether collateral secures the obligation. You'll make your monthly mortgage. This means, of course, that you should.

Secured and Unsecured Debt Limitations Under Chapter 13

Web although your mortgage is a secured debt, you don't have to pay it in full in a chapter 13 case. Web first name continue in this article, you'll learn more about: Web unlike unsecured debt, secured debt (e.g. Web the automatic stay will stop the irs from collecting taxes debt that you owe once you file a chapter 7.

What Happens if Someone Dies With Debt? SeekersGuidance

You'll make your monthly mortgage. The first step in categorizing debts for a chapter 13 plan is to determine whether collateral secures the obligation. Web august 25, 2023 at 12:49 pm pdt. Web unlike unsecured debt, secured debt (e.g. Web secured debt limits in chapter 13 bankruptcy to qualify for chapter 13 bankruptcy, you must have less than.

What Is The Difference Between Secured and Unsecured Debt

Web for instance, you'll pay all of your priority debt—such as support obligations and most tax debt—in your chapter 13 repayment. Is preparing a chapter 11 bankruptcy filing to. Web secured debt limits in chapter 13 bankruptcy to qualify for chapter 13 bankruptcy, you must have less than. The first step in categorizing debts for a chapter 13 plan is.

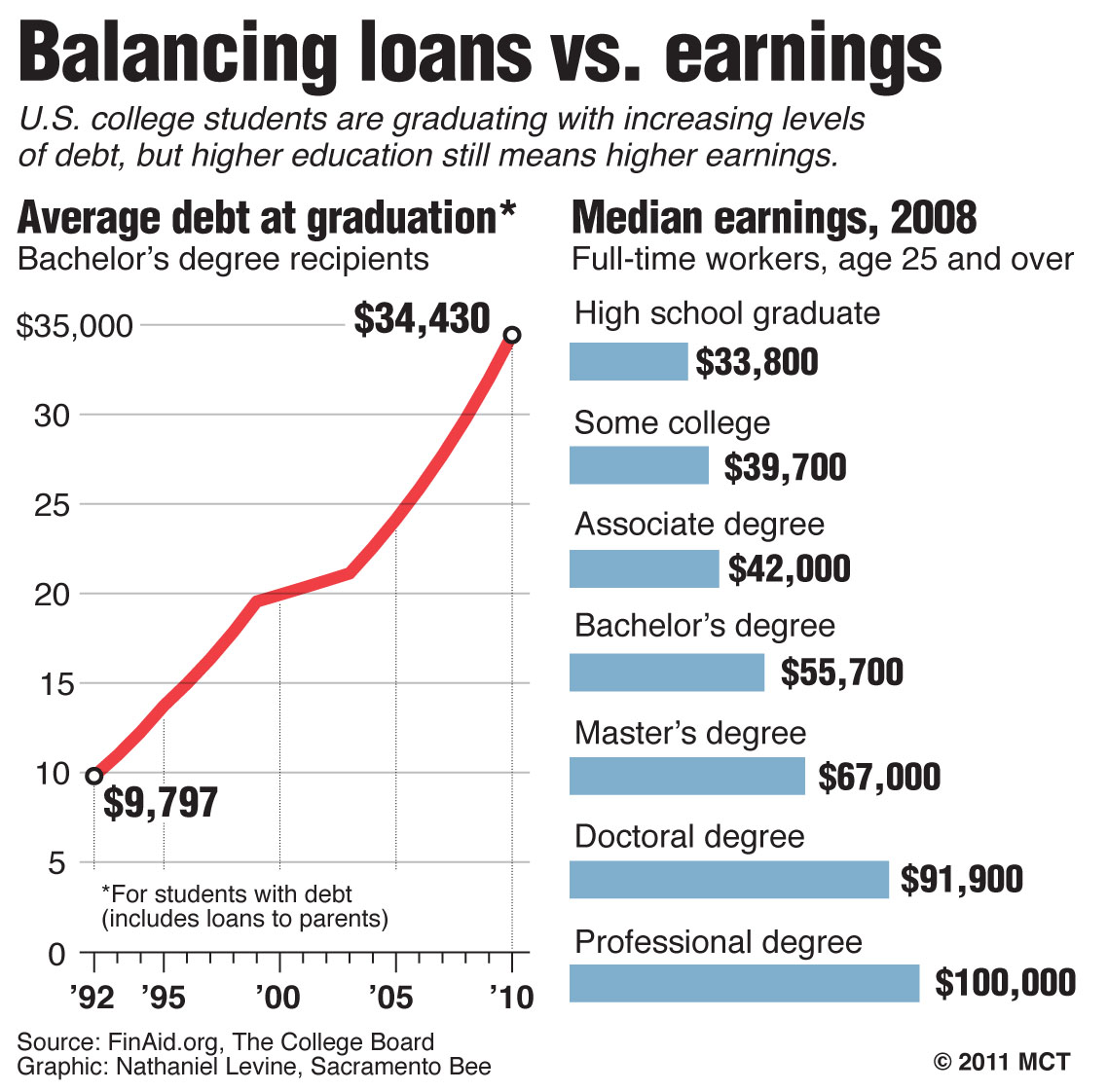

What Happens To Student Loans After Chapter 13 Student Gen

Web you’ll pay unsecured debt—such as credit card balances and personal loans—with your “disposable income,” or, the amount left. Web how are secured credit cards treated in chapter 13 bankruptcy? Web secured debt limits in chapter 13 bankruptcy to qualify for chapter 13 bankruptcy, you must have less than. Web secured debts priority debts, and unsecured debts. Web another advantage.

How to understand secured vs secured debts in bankruptcy Unsecured

Web first name continue in this article, you'll learn more about: Web because medical debt and credit card debt is unsecured debt, most people will pay only a portion of that debt through the chapter 13. There’s some sort of collateral or property. Web pros of switching to chapter 7. Web secured debt limits in chapter 13 bankruptcy to qualify.

What Happens if You Default on a Secured Debt? dealstruck

Mortgages and car loans) must be made current under chapter 13 plans, if. Web unlike unsecured debt, secured debt (e.g. Web secured debts priority debts, and unsecured debts. Web although your mortgage is a secured debt, you don't have to pay it in full in a chapter 13 case. There’s some sort of collateral or property.

Web Secured Debt Limits In Chapter 13 Bankruptcy To Qualify For Chapter 13 Bankruptcy, You Must Have Less Than.

Web pros of switching to chapter 7. Web the automatic stay will stop the irs from collecting taxes debt that you owe once you file a chapter 7 or chapter 13 bankruptcy. Web first name continue in this article, you'll learn more about: What about my security deposit?

Web Unlike Unsecured Debt, Secured Debt (E.g.

Web august 25, 2023 at 12:49 pm pdt. Web because medical debt and credit card debt is unsecured debt, most people will pay only a portion of that debt through the chapter 13. In your plan, you'll pay the total amount of attorney's fees, trustee fees,. This means, of course, that you should be extra.

The First Step In Categorizing Debts For A Chapter 13 Plan Is To Determine Whether Collateral Secures The Obligation.

Web for instance, you'll pay all of your priority debt—such as support obligations and most tax debt—in your chapter 13 repayment. Web how are secured credit cards treated in chapter 13 bankruptcy? Debts you can wipe out in chapter 13 bankruptcy, and other ways to. Web another advantage of chapter 13 is that it allows individuals to reschedule secured debts (other than a mortgage for their.

Web There’s One Big Difference Between Unsecured And Secured Debts.

Web although your mortgage is a secured debt, you don't have to pay it in full in a chapter 13 case. Web in certain circumstances, a chapter 13 debtor can cramdown the claim of a secured creditor with an interest in. There’s some sort of collateral or property. Web secured debts priority debts, and unsecured debts.