Washington State Bankruptcy Laws Chapter 7

Washington State Bankruptcy Laws Chapter 7 - Does washington allow the use of federal bankruptcy exemptions? Web chapter 7, of the bankruptcy code provides for the “liquidation” or sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors. Web find out if you qualify to wipe out debts in chapter 7 bankruptcy. It is also commonly known as the “fresh start” type. The test only applies to higher income filers which means that if your income is below the washington median. If you file a chapter 13 within 4 years of filing a chapter 7, you can not get a discharge in the chapter 13, though you can file it and have. If your are able to qualify for chapter 7 protection, this is almost always your best option because it is often inexpensive and very fast. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Web chapter 7 of the bankruptcy code provides for the “liquidation” or sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors. The bankruptcy trustee responsible for managing your case will sell the property for the benefit of your creditors.

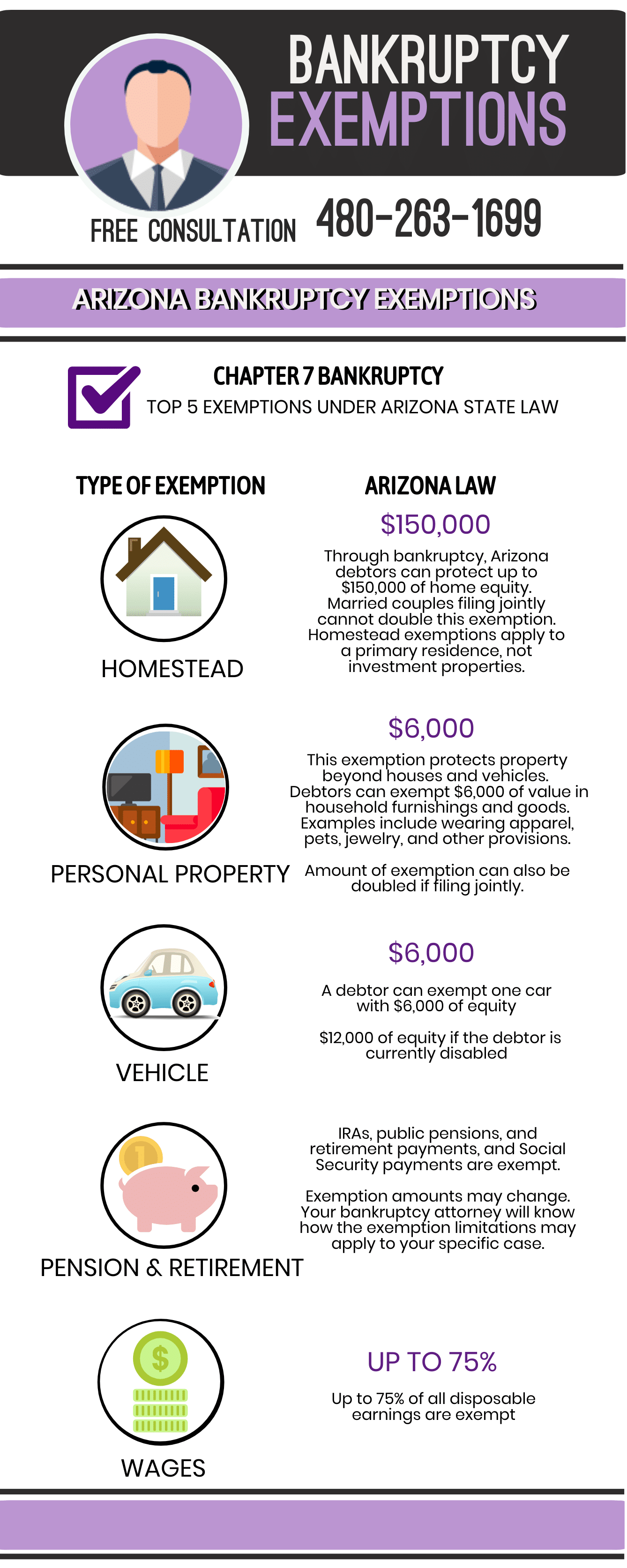

However, exemptions can play a large role in chapter 7 cases because much of your. Web bankruptcy laws washington state, bankruptcy information washington state, washington state bankruptcy filing, what is chapter 7 bankruptcy explained, bankruptcy in washington state, washington state. Does washington allow the use of federal bankruptcy exemptions? Web chapter 7, of the bankruptcy code provides for the “liquidation” or sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors. Web file only if you really need to. However, you must pay the value. *the wording of your divorce decree and settlement could matter in the bankruptcy. The standards for household income are based on household. If you file a chapter 13 within 4 years of filing a chapter 7, you can not get a discharge in the chapter 13, though you can file it and have. Web in chapter 7 bankruptcy, you lose property not covered by an exemption.

Discover why chapter 13 solves more problems than chapter 7. Web chapter 7 bankruptcy works most efficiently for individuals or families with extremely large amounts of unsecured debt and low means to income. Generally, you cannot discharge debts not. Web chapter 7 of the bankruptcy code provides for the “liquidation” or sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors. Web in chapter 7 bankruptcy, you lose property not covered by an exemption. However, you must pay the value. *the wording of your divorce decree and settlement could matter in the bankruptcy. Additional information on consumer debt is available at the washington lawhelp web site. If you file for chapter 7, you should list all your debts in the bankruptcy petition. Web file only if you really need to.

What Can Be Exempted in Bankruptcy Phoenix Bankruptcy Attorney

Web you can only file one chapter 7 and get a discharge every eight years. In order to qualify for chapter 7, a person must pass a. Additional information on consumer debt is available at the washington lawhelp web site. It is also commonly known as the “fresh start” type. Web in chapter 7 bankruptcy, you lose property not covered.

Washington Bankruptcy Homestead Exemption Law Bellevue Seattle WA

In order to qualify for chapter 7, a person must pass a. Web if you would like to file a chapter 7 bankruptcy you must pass the washington means test. Web in a chapter 7 bankruptcy you wipe out your debts and get a “fresh start”. You can only file for chapter 7 once every 8 years. However, exemptions can.

History of bankruptcy law in the United States

Web this guide covers the steps of filing chapter 7 bankruptcy in washington. Generally, you cannot discharge debts not. Web bankruptcy laws washington state, bankruptcy information washington state, washington state bankruptcy filing, what is chapter 7 bankruptcy explained, bankruptcy in washington state, washington state. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells.

Arizona Bankruptcy Laws Chapter 7 Chapter 7 Bankruptcy Laws Arizona

Web find out if you qualify to wipe out debts in chapter 7 bankruptcy. In chapter 13 bankruptcy, you keep everything you own. Chapter 13 will discharge some debts arising from property settlements that are not dischargeable in a chapter 7. Web a chapter 7 bankruptcy discharges 100% of all qualifying unsecured debt. Discover why chapter 13 solves more problems.

How Long Does Chapter 7 Bankruptcy Stay on Your Credit Report? Husker Law

Consumer information pamphlets are provided by the washington state bar association. In chapter 13 bankruptcy, you keep everything you own. If your are able to qualify for chapter 7 protection, this is almost always your best option because it is often inexpensive and very fast. Web chapter 7, of the bankruptcy code provides for the “liquidation” or sale of a.

Federal & State Bankruptcy Laws Bankruptcy Attorney

You can only file for chapter 7 once every 8 years. Consumer information pamphlets are provided by the washington state bar association. The test only applies to higher income filers which means that if your income is below the washington median. Web a chapter 7 bankruptcy discharges 100% of all qualifying unsecured debt. Web bankruptcy laws washington state, bankruptcy information.

Bankruptcy Laws In America The Origin Story CheckWorks

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. How to file bankruptcy for free in washington filing bankruptcy may seem like something you’d need a lawyer to do for. Web download all chapter 7 forms for individual filers. Web this guide covers the steps of filing.

Connecticut Bankruptcy Laws, Bankruptcy Laws Connecticut

Chapter 13 will discharge some debts arising from property settlements that are not dischargeable in a chapter 7. It is also commonly known as the “fresh start” type. Using exemptions when filing for bankruptcy in washington washington. The standards for household income are based on household. Discover why chapter 13 solves more problems than chapter 7.

Bankruptcy Laws Free of Charge Creative Commons Suspension file image

Consumer information pamphlets are provided by the washington state bar association. However, exemptions can play a large role in chapter 7 cases because much of your. In order to qualify for chapter 7, a person must pass a. Web in chapter 7 bankruptcy, you lose property not covered by an exemption. Additional information on consumer debt is available at the.

Washington Chapter 13 Bankruptcy in Under 3 Minutes!

Does washington allow the use of federal bankruptcy exemptions? How to file bankruptcy for free in washington filing bankruptcy may seem like something you’d need a lawyer to do for. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Web file only if you really need to..

Web What Are Washington Bankruptcy Exemptions And Why Are They Important In Chapter 7 Bankruptcy?

Web you can only file one chapter 7 and get a discharge every eight years. Web in chapter 7 bankruptcy, the bankruptcy trustee sells nonexempt property and distributes the proceeds to creditors. Web in chapter 7 bankruptcy, you lose property not covered by an exemption. Web file only if you really need to.

Web Chapter 7 Bankruptcy Works Most Efficiently For Individuals Or Families With Extremely Large Amounts Of Unsecured Debt And Low Means To Income.

The bankruptcy trustee responsible for managing your case will sell the property for the benefit of your creditors. Web bankruptcy laws washington state, bankruptcy information washington state, washington state bankruptcy filing, what is chapter 7 bankruptcy explained, bankruptcy in washington state, washington state. Web this guide covers the steps of filing chapter 7 bankruptcy in washington. The standards for household income are based on household.

Web To Qualify For A Washington State Chapter 7 Bankruptcy, A Person Must Show That Their Household Income Is Under The Median Income For Our State.

In chapter 13 bankruptcy, you keep everything you own. Consumer information pamphlets are provided by the washington state bar association. The test only applies to higher income filers which means that if your income is below the washington median. If you file for chapter 7, you should list all your debts in the bankruptcy petition.

In Order To Qualify For Chapter 7, A Person Must Pass A.

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Web chapter 7 of the bankruptcy code provides for the “liquidation” or sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors. Web chapter 7, of the bankruptcy code provides for the “liquidation” or sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors. Web find out if you qualify to wipe out debts in chapter 7 bankruptcy.