Texas Median Income For Chapter 7

Texas Median Income For Chapter 7 - This test basically compares your income to the median income for a household of the same size. When taking the chapter 7 means test to see if you qualify for chapter 7 bankruptcy, your household size determines how much you can earn. If your gross income based on the six months before filing bankruptcy is below the median income. Web household size and the chapter 7 means test. Those who don’t pass the means test, but still want to file bankruptcy will have to file for chapter. That means that your net pay will be $59,995 per year, or $5,000 per month. The test only applies to higher income filers which means that if your income is below the texas median for your household size you are exempt from the test and may file a chapter. Web if it’s less than the texas median income, then you are eligible to file a chapter 7 provided you meet other legal requirements. Your average tax rate is 20.0% and your marginal tax rate is 29.7%. Web the new median income numbers for every state are 7.4% higher than those released in november 1, 2022, which can mean a rather sizeable increase.

This test basically compares your income to the median income for a household of the same size. Web if it’s less than the texas median income, then you are eligible to file a chapter 7 provided you meet other legal requirements. Suppose your household size and income don't exceed the median. Web the reason the state median isn’t an “income limit,” is that those whose income is higher may still be able to file chapter 7 if the means test determines they don’t have the income to pay the debt they owe. If it’s higher, you have to move on to the next step in the means test, which takes your expenses and disposable income. If your income is lower, you pass the test. Those who don’t pass the means test, but still want to file bankruptcy will have to file for chapter. If a debtor’s current monthly household income is less than the texas median income for a household of their size there is a presumption that they may pass the means test and are eligible to file a chapter 7. Web if the debtor’s median income exceeds the median income for other texas households, the debtor cannot use chapter 7 and must instead file a petition under chapter 13. If your cmi is more than the texas median income then a more complicated expense formula is used to determine whether you can file a chapter 7.

Those who don’t pass the means test, but still want to file bankruptcy will have to file for chapter. In the test, you compare your income with the median income of a similar size household in your state. The original source for the state median family income. Web for those whose income falls between $7,475 and $12,475, further calculations can be used to determine if they can file a chapter 7. The state you live in. If your gross income based on the six months before filing bankruptcy is below the median income. Suppose your household size and income don't exceed the median. Your income from all sources. Seek guidance before a bankruptcy filing This marginal tax rate means that your immediate additional income.

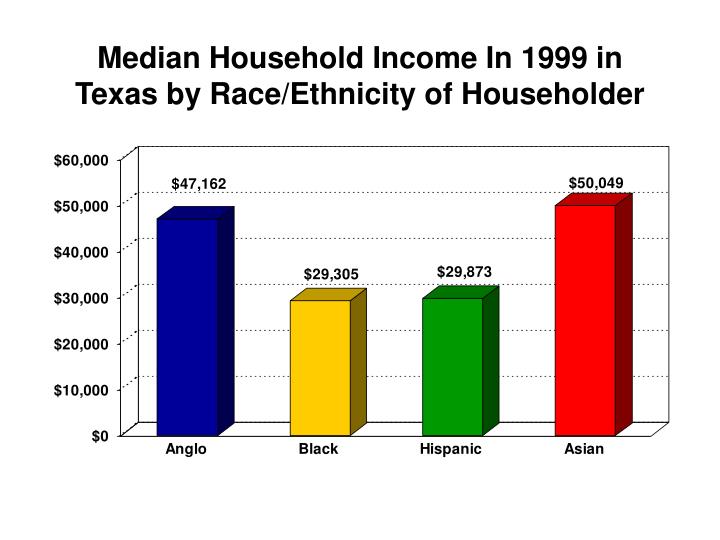

PPT The Population of Texas Historical Patterns and Future Trends

When taking the chapter 7 means test to see if you qualify for chapter 7 bankruptcy, your household size determines how much you can earn. General information regarding irs collection financial standards collection financial standards are used to help determine a taxpayer's ability to pay a delinquent tax liability. Web if you make $75,000 a year living in the region.

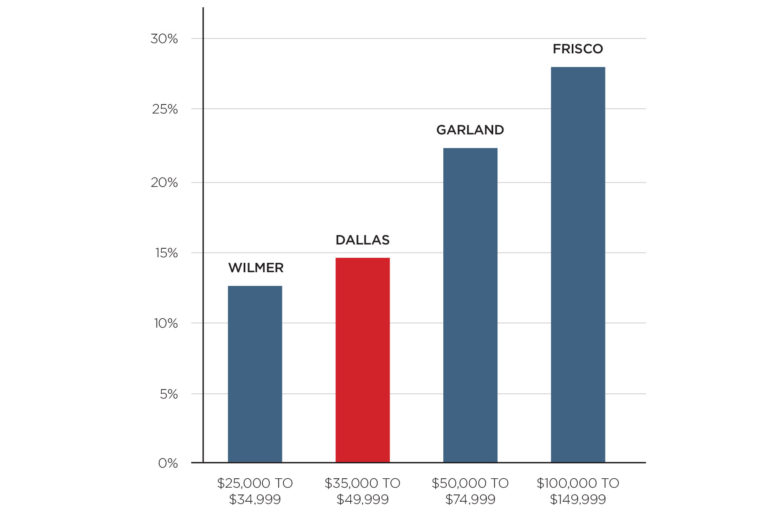

Dallas Lags Behind in Median Family D Magazine

Web if the debtor’s median income exceeds the median income for other texas households, the debtor cannot use chapter 7 and must instead file a petition under chapter 13. When taking the chapter 7 means test to see if you qualify for chapter 7 bankruptcy, your household size determines how much you can earn. Web if you would like to.

Good news and bad news when it comes to Alabama's median

If it’s higher, you have to move on to the next step in the means test, which takes your expenses and disposable income. Web if it’s less than the texas median income, then you are eligible to file a chapter 7 provided you meet other legal requirements. This marginal tax rate means that your immediate additional income. Web household size.

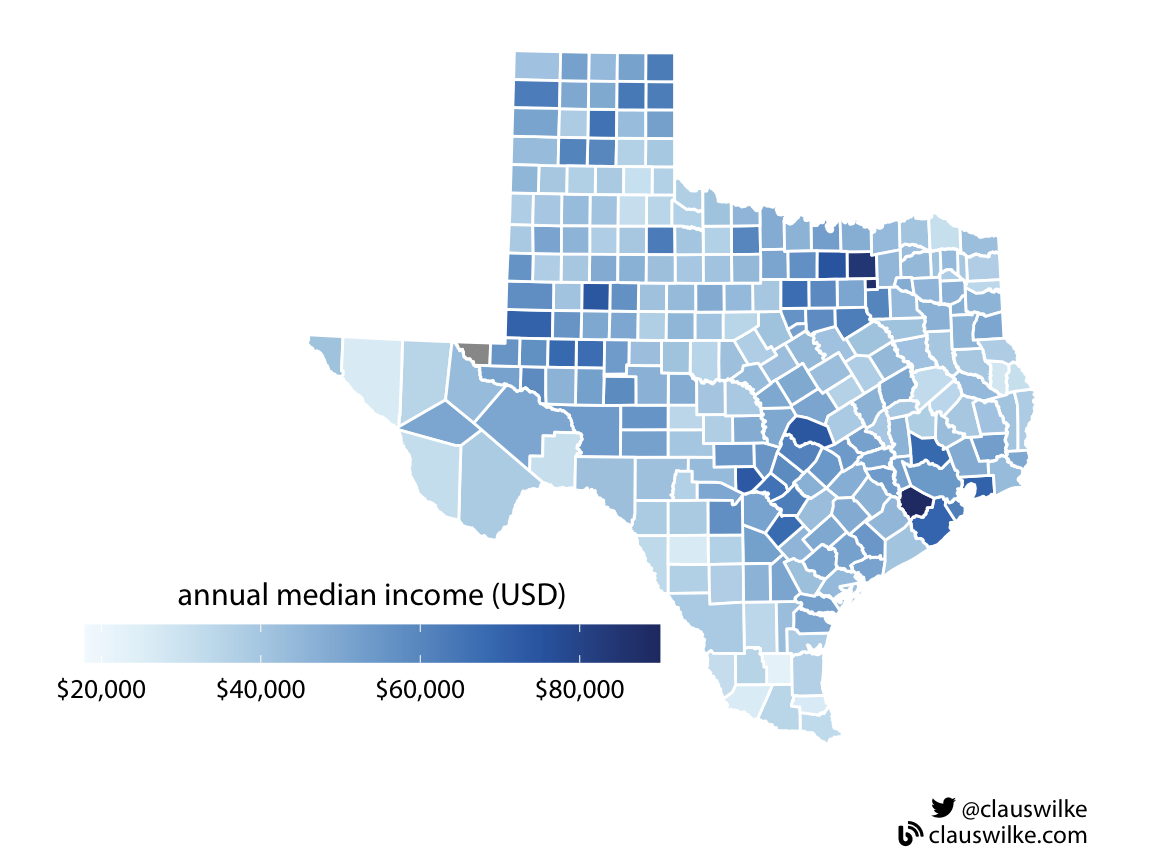

Writing a blogdown post for the ages Claus O. Wilke

The test only applies to higher income filers which means that if your income is below the texas median for your household size you are exempt from the test and may file a chapter. Web the chapter 7 means test determines whether allowing someone to discharge their debts would be an abuse of the bankruptcy system. If a debtor’s current.

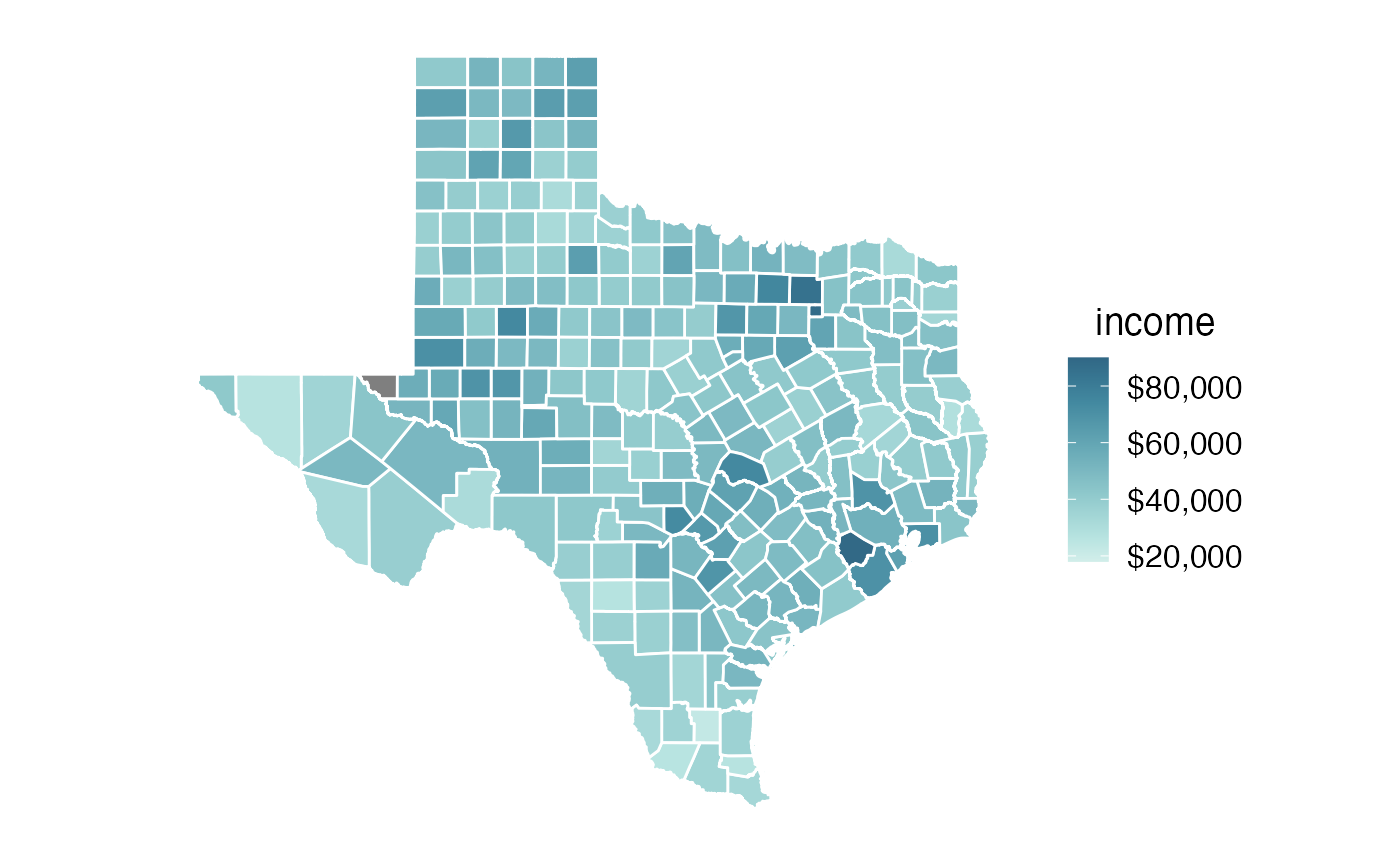

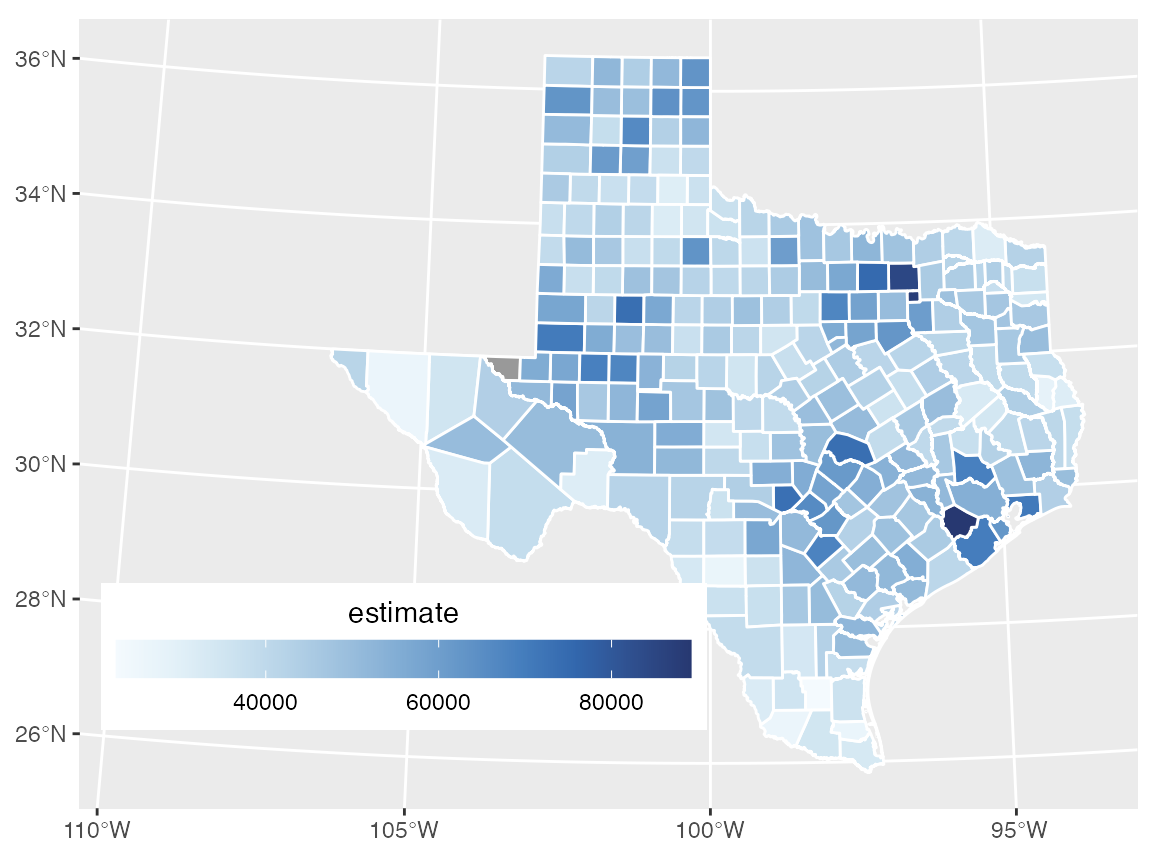

Median in Texas counties — • practicalgg

This marginal tax rate means that your immediate additional income. Your income from all sources. If your gross income based on the six months before filing bankruptcy is below the median income. Suppose your household size and income don't exceed the median. When taking the chapter 7 means test to see if you qualify for chapter 7 bankruptcy, your household.

Austin to help pay rent, mortgages for more people KXAN Austin

If your gross income based on the six months before filing bankruptcy is below the median income. The original source for the state median family income. Web the reason the state median isn’t an “income limit,” is that those whose income is higher may still be able to file chapter 7 if the means test determines they don’t have the.

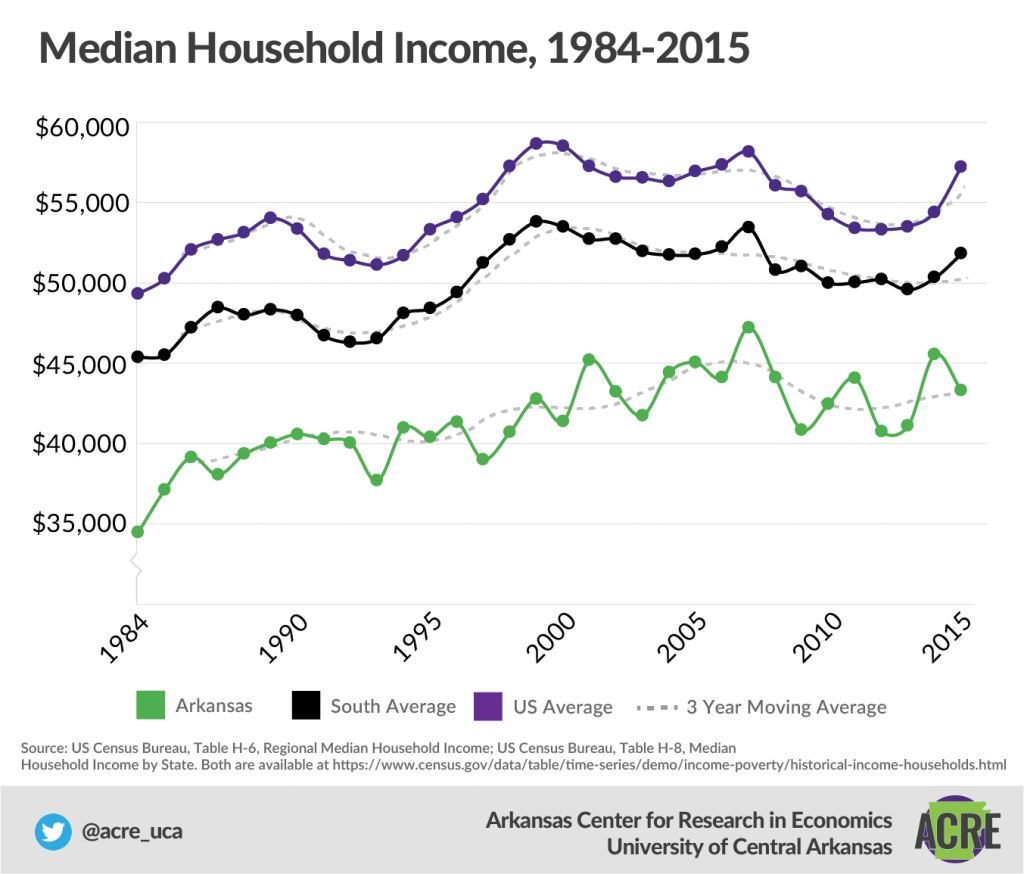

Citizen’s Guide Median Household Arkansas Center for

As of november 1, 2016, the median income for texas. Web the chapter 7 means test determines whether allowing someone to discharge their debts would be an abuse of the bankruptcy system. This test basically compares your income to the median income for a household of the same size. Your average tax rate is 20.0% and your marginal tax rate.

Texas Rent Report — April 2015

Web to qualify for chapter 7 bankruptcy, you need to pass a means test. This test basically compares your income to the median income for a household of the same size. Suppose your household size and income don't exceed the median. Your average tax rate is 20.0% and your marginal tax rate is 29.7%. Web the chapter 7 means test.

I would rather live next to 4 Muslim neighbors than 4 Trump supporters

Web if you would like to file a chapter 7 bankruptcy you must pass the texas means test. This marginal tax rate means that your immediate additional income. Web the chapter 7 means test determines whether allowing someone to discharge their debts would be an abuse of the bankruptcy system. Web the new median income numbers for every state are.

Median Texas by county • practicalgg

Web the chapter 7 means test determines whether allowing someone to discharge their debts would be an abuse of the bankruptcy system. Suppose your household size and income don't exceed the median. Web if you would like to file a chapter 7 bankruptcy you must pass the texas means test. If it’s higher, you have to move on to the.

Web The Reason The State Median Isn’t An “Income Limit,” Is That Those Whose Income Is Higher May Still Be Able To File Chapter 7 If The Means Test Determines They Don’t Have The Income To Pay The Debt They Owe.

This test basically compares your income to the median income for a household of the same size. If your gross income based on the six months before filing bankruptcy is below the median income. Web if you make $75,000 a year living in the region of texas, usa, you will be taxed $15,006. If it’s higher, you have to move on to the next step in the means test, which takes your expenses and disposable income.

The Median Family Income Figures.

Suppose your household size and income don't exceed the median. In the test, you compare your income with the median income of a similar size household in your state. The original source for the state median family income. Web if the debtor’s median income exceeds the median income for other texas households, the debtor cannot use chapter 7 and must instead file a petition under chapter 13.

Your Average Tax Rate Is 20.0% And Your Marginal Tax Rate Is 29.7%.

This marginal tax rate means that your immediate additional income. Web if it’s less than the texas median income, then you are eligible to file a chapter 7 provided you meet other legal requirements. If a debtor’s current monthly household income is less than the texas median income for a household of their size there is a presumption that they may pass the means test and are eligible to file a chapter 7. People who qualify for a chapter 7 bankruptcy are people whose.

Web On April 1, 2021, The Median Family Income Used In The Means Test Calculation To Determine Your Eligibility To File A Chapter 7 Bankruptcy Case Will Change In Texas.

As of november 1, 2016, the median income for texas. Your income from all sources. If your cmi is more than the texas median income then a more complicated expense formula is used to determine whether you can file a chapter 7. Seek guidance before a bankruptcy filing