How To Read A 990 Form

How To Read A 990 Form - These forms contain a wealth of information about charities, but like most tax forms, they can be a bear to digest. Putting personal identifying information not required by the irs on the return facilitates identify theft. In a nutshell, the form gives the irs an overview of the organization's activities,. This is an important figure to track. Web how to read a charity 990 tax form every year most charities must file a 990 tax return with the irs. Public charity status and public support pdf. Web information about their assets, received contributions and grants, as well as expenses and board of trustees can be found on the annual filing. Web how to read a 990. Start on page one, and search through the 990 for the fields and pages described below. It might be helpful to look at examples of 990s as you read along.

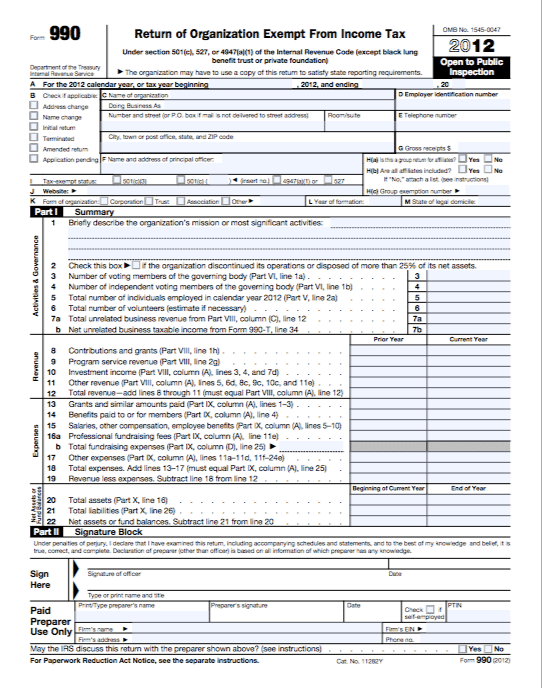

Instructions for form 990 pdf. Web how to read a 990? Web form 990 must be made publicly available by the irs and the filer; Public charity status and public support pdf. Web how to read a charity 990 tax form every year most charities must file a 990 tax return with the irs. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. Breakdown of a 990 form; Web information about their assets, received contributions and grants, as well as expenses and board of trustees can be found on the annual filing. Web how to read a 990. When you review your draft form 990 before it gets.

Web how to read a 990. Web information about their assets, received contributions and grants, as well as expenses and board of trustees can be found on the annual filing. Web the irs requires all u.s. A red flag guide for nonprofits is a recording of a webinar hosted by nonprofit quarterly with chuck mclean of guidestar. Breakdown of a 990 form; Public charity status and public support pdf. Certain exempt organizations file this form to provide the. Instructions for form 990 pdf. This is an important figure to track. Web how to read a 990?

Blog 1 Tips on How to Read Form 990

Form 990 is an annual reporting return that many. Putting personal identifying information not required by the irs on the return facilitates identify theft. I usually look at three years of forms whenever i do. Web form 990 must be made publicly available by the irs and the filer; Web how to read a 990.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Check out the fair market value of assets. Public charity status and public support pdf. Web the irs requires all u.s. Web information about their assets, received contributions and grants, as well as expenses and board of trustees can be found on the annual filing. Web how to read a 990.

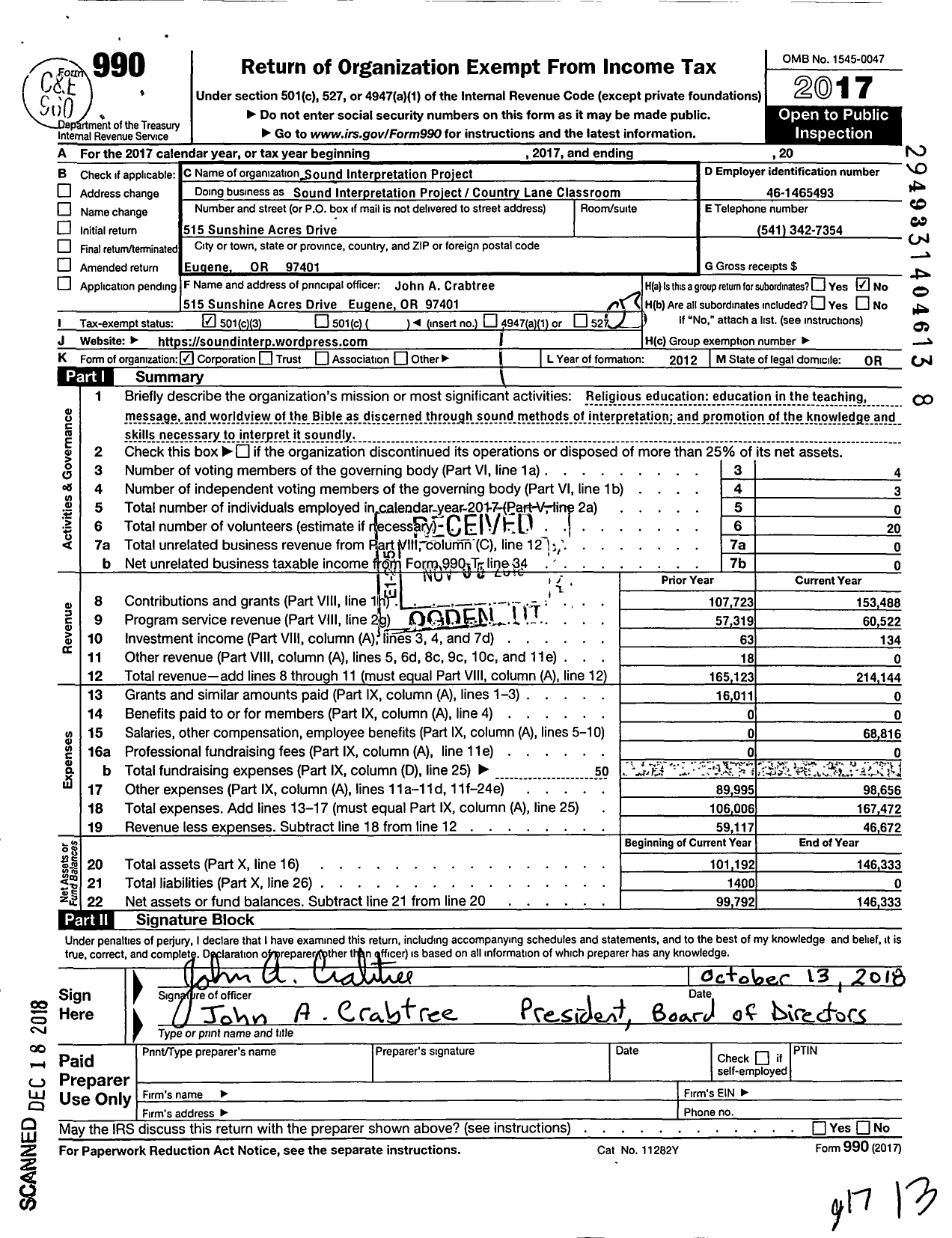

2017 Form 990 for Sound Interpretation Project Cause IQ

Web how to read a charity 990 tax form every year most charities must file a 990 tax return with the irs. Web form 990 must be made publicly available by the irs and the filer; Start on page one, and search through the 990 for the fields and pages described below. Certain exempt organizations file this form to provide.

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

Though it may appear technical and intimidating at first glance, a 990 isn’t hard. It might be helpful to look at examples of 990s as you read along. I usually look at three years of forms whenever i do. Start on page one, and search through the 990 for the fields and pages described below. Putting personal identifying information not.

This is page 1 of the Form 990. Let’s answer some questions about t…

Instructions for form 990 pdf. Check out total assets for the end of year. Breakdown of a 990 form; Web how to read a charity 990 tax form every year most charities must file a 990 tax return with the irs. It might be helpful to look at examples of 990s as you read along.

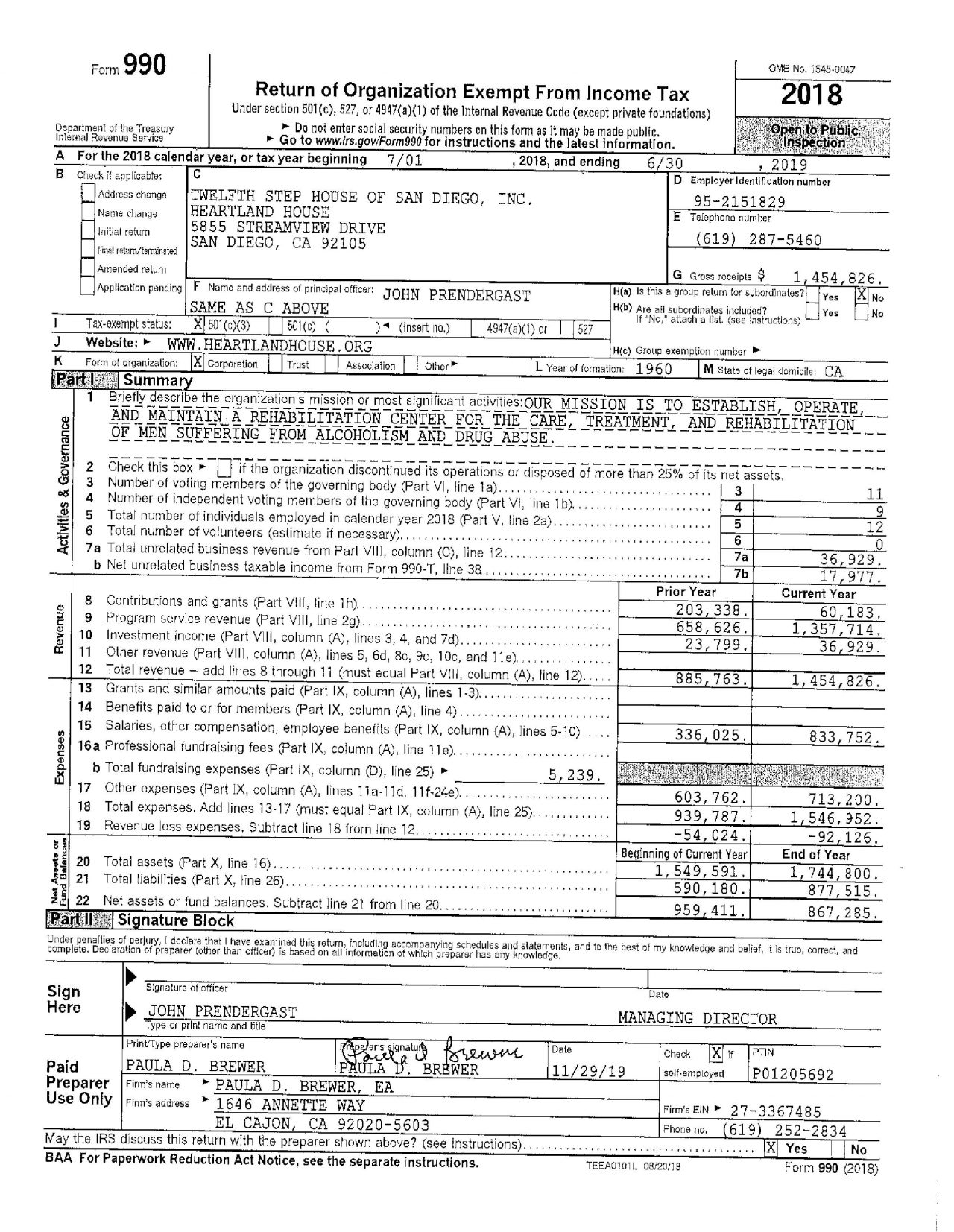

IRS Form 990 Heartland House

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. This is an important figure to track. Web information about their assets, received contributions and grants, as well as expenses and board of trustees can be found on the annual filing. Web making the most of your.

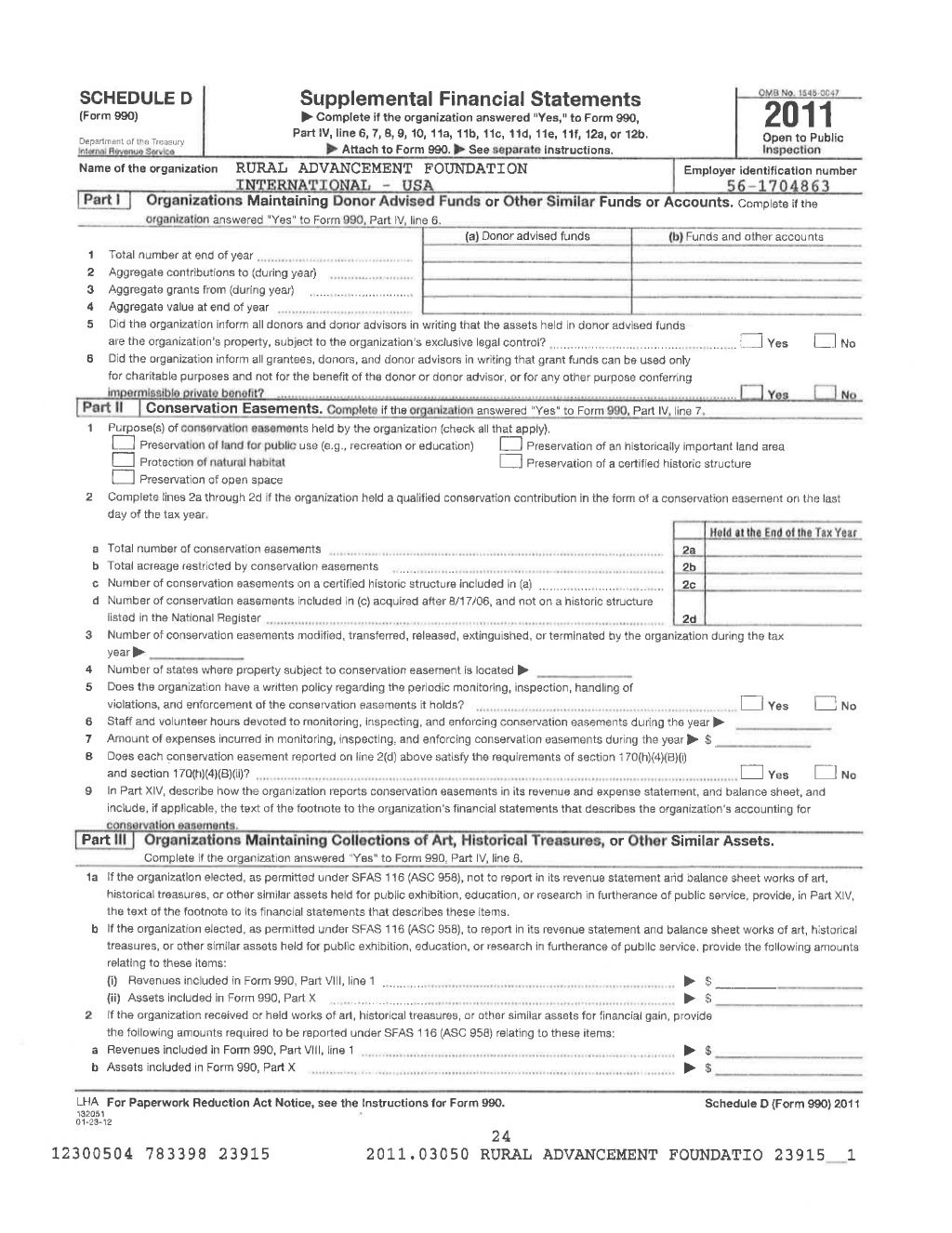

Part 1, 2011 Form 990

Web how to read a form 990. Examine many of the same research resources as you would for other companies Form 990 is an annual reporting return that many. In a nutshell, the form gives the irs an overview of the organization's activities,. Though it may appear technical and intimidating at first glance, a 990 isn’t hard.

Calendar Year Tax Year? Your 990 Is Due Tony

Web the irs requires all u.s. Putting personal identifying information not required by the irs on the return facilitates identify theft. In a nutshell, the form gives the irs an overview of the organization's activities,. Web how to read a charity 990 tax form every year most charities must file a 990 tax return with the irs. Examine many of.

What Is the IRS Form 990? File 990

Web how to read a charity 990 tax form every year most charities must file a 990 tax return with the irs. Web how to read a 990. Certain exempt organizations file this form to provide the. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1).

A Red Flag Guide For Nonprofits Is A Recording Of A Webinar Hosted By Nonprofit Quarterly With Chuck Mclean Of Guidestar.

Check out the fair market value of assets. In a nutshell, the form gives the irs an overview of the organization's activities,. Breakdown of a 990 form; Web how to read a form 990.

Instructions For Form 990 Pdf.

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. These forms contain a wealth of information about charities, but like most tax forms, they can be a bear to digest. Web how to read a 990. Web how to read a charity 990 tax form every year most charities must file a 990 tax return with the irs.

Web Making The Most Of Your Form 990:

Web information about their assets, received contributions and grants, as well as expenses and board of trustees can be found on the annual filing. Start on page one, and search through the 990 for the fields and pages described below. Public charity status and public support pdf. Putting personal identifying information not required by the irs on the return facilitates identify theft.

Check Out Total Assets For The End Of Year.

Web how to read a 990? When you review your draft form 990 before it gets. Certain exempt organizations file this form to provide the. I usually look at three years of forms whenever i do.