How Is Chapter 13 Payment Calculated

How Is Chapter 13 Payment Calculated - $2,000 per month for required debt payments ($2,000 x 60 payments = $120,000), and. Web here's what you'd need to pay through your plan: Payments are also subject to multiple other tests. The court looks at your income from the six months before your. Web to file for chapter 13 as an individual, your combined secured and unsecured debts total less than $2.75 million. The unsecured debts may be paid as low as. Web this article explains how to determine the amount you'd pay in a chapter 13 monthly payment. Web chapter 13 payment calculator. It enables individuals with regular income to develop a plan to repay all or part of their debts. Web in chapter 13 bankruptcy, you'll divide debt into secured debt, priority unsecured debt, and general unsecured debt.

Web here's what you'd need to pay through your plan: Web to determine your monthly payment amount, you must complete the chapter 13 means test as a part of your paperwork submission to courts. Determine your monthly income a determination of your chapter 13 monthly payment amount starts with a determination of your income. Ad this chapter 13 calculator helps you estimate your plan payment for chapter 13 plans. Below you will find articles about the chapter 13 plan, including how to calculate your monthly plan payment, which debts are paid in full and which in part through the plan, and what to do if you can't make your plan payments. The minimum payment calculator does not consider disposable income and. Under this chapter, debtors propose a repayment. The chapter 13 filing process generally takes 95 days from the filing of the petition to the approval of the repayment plan. Below is a simple calculator to help you determine what your minimum chapter 13 payment may be. Sufficient time has passed since your last filing.

Sufficient time has passed since your last filing. Web the goal is to resolve some debts and get current on secured loans — those with collateral, such as a home or car. For instance, you'll pay all of your priority debt —such as support obligations and most tax debt—in your chapter 13. Your chapter 13 plan must calculate chapter 13 plan payments that pay the secured and priority debts in full. You can also estimate your minimum chapter 13 payment using our chapter 13 payment calculator. Here’s what to expect over a typical chapter 13. Web chapter 13 payment calculator. Web background a chapter 13 bankruptcy is also called a wage earner's plan. Under this chapter, debtors propose a repayment. The minimum payment calculator does not consider disposable income and.

I Can't Afford My Chapter 13 Payment What Are My Options? Law

Web chapter 13 payment calculator. 3) monthly payment toward the “might pay… To get a monthly figure, you'll add up what you must pay. Web this article explains how to determine the amount you'd pay in a chapter 13 monthly payment. Below you will find articles about the chapter 13 plan, including how to calculate your monthly plan payment, which.

How is Your Chapter 13 Payment Calculated? Parker & DuFresne

$500 per month toward dischargeable debt ($500 x 60 payments = $30,000). Web chapter 13 payment calculator. In this case, you'd be short $500 per month and wouldn't qualify for chapter 13. Web the minimum payment chapter 13 calculator will help compute an accurate estimate of your minimum chapter 13 plan payment. Here's how to figure out if chapter 13.

Chapter 13 Payment Plan Example Sirody & Assoc.

Web to determine your monthly payment amount, you must complete the chapter 13 means test as a part of your paperwork submission to courts. To get a monthly figure, you'll add up what you must pay. The chapter 13 filing process generally takes 95 days from the filing of the petition to the approval of the repayment plan. The following.

Chapter 13 Payment Plan Example

Web how much you'll pay in a chapter 13 plan. This calculator gives you an estimate of what your minimum payment might be if you file a chapter 13 bankruptcy. Web this article explains how to determine the amount you'd pay in a chapter 13 monthly payment. Calculator uses means test for missouri. Ad this chapter 13 calculator helps you.

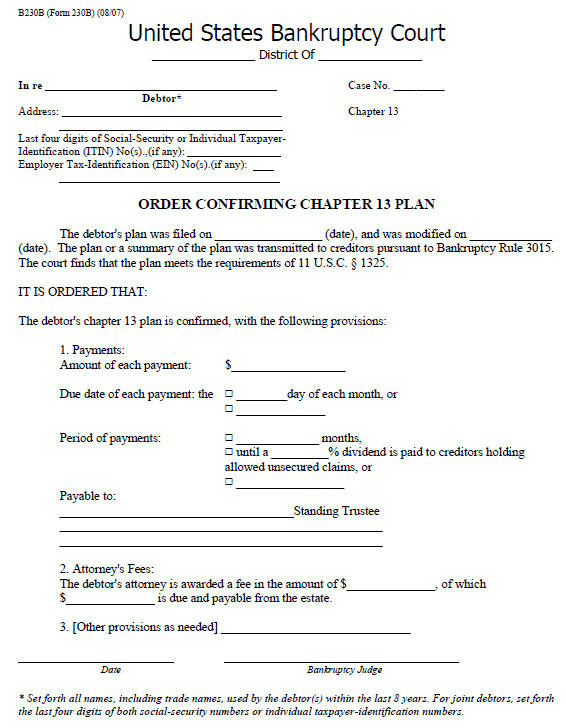

Chapter 13 Payment Plan Form

The unsecured debts may be paid as low as. The following factors must be considered when calculating a chapter 13 monthly payment: How much you must pay for each type of debt differs. Web in chapter 13 bankruptcy, you'll divide debt into secured debt, priority unsecured debt, and general unsecured debt. Web how to calculate chapter 13 plan payments •.

Chapter 13 Calculator Chapter 13 Payment Calculator O'Bryan

Below you will find articles about the chapter 13 plan, including how to calculate your monthly plan payment, which debts are paid in full and which in part through the plan, and what to do if you can't make your plan payments. Web background a chapter 13 bankruptcy is also called a wage earner's plan. This calculator gives you an.

How Long Will Chapter 13 Bankruptcy Delay Foreclosure? 4 Things to Know

The following factors must be considered when calculating a chapter 13 monthly payment: For instance, you'll pay all of your priority debt —such as support obligations and most tax debt—in your chapter 13. The unsecured debts may be paid as low as. Web in a nutshell. Sufficient time has passed since your last filing.

Calculating a Chapter 13 Payment Amount

Determine your monthly income a determination of your chapter 13 monthly payment amount starts with a determination of your income. Web chapter 13 payment calculator. Web cisowski law chapter 13 calculator is an algorithm that uses 4 pages of information from the user and combines them with a number of assumptions, legal rules, and standard variables to reach a precise.

Determining Chapter 13 Payment Amount Bymaster Bankruptcy

How much you must pay for each type of debt differs. The chapter 13 filing process generally takes 95 days from the filing of the petition to the approval of the repayment plan. Determine your monthly income a determination of your chapter 13 monthly payment amount starts with a determination of your income. The court looks at your income from.

Understanding the Chapter 13 Payment Plan Steiner Law Group, LLC

Web the chapter 13 process. How much you must pay for each type of debt differs. Web chapter 13 payment calculator. Web background a chapter 13 bankruptcy is also called a wage earner's plan. $2,000 per month for required debt payments ($2,000 x 60 payments = $120,000), and.

Know Your Options To Make Most Informed Decision.

$500 per month toward dischargeable debt ($500 x 60 payments = $30,000). Determine your monthly income a determination of your chapter 13 monthly payment amount starts with a determination of your income. Web here's what you'd need to pay through your plan: Below you will find articles about the chapter 13 plan, including how to calculate your monthly plan payment, which debts are paid in full and which in part through the plan, and what to do if you can't make your plan payments.

This Not Only Determines How Long Your Repayment Plan Will Last But Also The Amount You Must Pay.

The unsecured debts may be paid as low as. Sufficient time has passed since your last filing. This page is designed to teach you how to calculate your minimum monthly payment for chapter 13 bankruptcy. Web the chapter 13 process.

To Get A Monthly Figure, You'll Add Up What You Must Pay.

Below is a simple calculator to help you determine what your minimum chapter 13 payment may be. Web the minimum payment chapter 13 calculator will help compute an accurate estimate of your minimum chapter 13 plan payment. Web how much you'll pay in a chapter 13 plan. Payments are also subject to multiple other tests.

Web How To Calculate Chapter 13 Plan Payments • Video.

The following factors must be considered when calculating a chapter 13 monthly payment: Web to file for chapter 13 as an individual, your combined secured and unsecured debts total less than $2.75 million. For instance, you'll pay all of your priority debt —such as support obligations and most tax debt—in your chapter 13. How much you must pay for each type of debt differs.