Chapter 3 Dave Ramsey Test

Chapter 3 Dave Ramsey Test - (student versions of the activities can be found under class content by chapter and lesson.) answers for tests,. They are what's known as predatory lenders. Decreases in assets or increases in liabilities from ongoing operations. Web answer keys for activities are located in teacher resources section, by chapter. Click the card to flip 👆. Web ramsey classroom chapter 3. Emergencies, large purchases, and wealth building. Once you're out of school, have started your career,. Plan your spending and avoid impulse or unnecessary spending. Live on less than you make.

These pdfs are a teacher versions with instructions and answers. They have never had a budget that worked. Once you're out of school, have started your career,. A summary that shows total income and spending for a given time period. Click the card to flip 👆. The amount of an individual's income that is left for spending, investing or saving after taxes and. Web dave ramsey chapter 3. Cram.com makes it easy to. Web study flashcards on dave ramsey finance: A budget has been used to abuse them.

Web identify where each of universal’s two primary businesses—passenger cars and information processing—is in such a cycle. They are what's known as predatory lenders. Cram.com makes it easy to. Which of the following account records would have the most current balance? What is dave ramsey's first foundation of. Emergencies, large purchases, and wealth building. These pdfs are a teacher versions with instructions and answers. Once you're out of school, have started your career,. Click the card to flip 👆. A summary that shows total income and spending for a given time period.

Digital Network Railcard from Trainline YouTube

The amount you pay after the deductible is met. Click the card to flip 👆 1 / 27 flashcards learn test. Web to have cash on hand for unexpected events. A summary that shows total income and spending for a given time period. Web dave ramsey chapter 3.

Review Chapter Three Dave Ramsey Money Matters Individual Retirement

Quickly memorize the terms, phrases and much more. Plan your spending and avoid impulse or unnecessary spending. 47% of americans have less than $1,000 saved for a (n) ______. They are what's known as predatory lenders. Decreases in assets or increases in liabilities from ongoing operations.

Dave Ramsey's Best Home Buying Tips Family Handyman

Click the card to flip 👆. If your parents buy you clothes or give you money to go out with your friends, pay for a club or athletic fees, or put gas in your car, all of those represent _______ that are flowing right through your fingers. Web study flashcards on dave ramsey chapter 3 flashcards at cram.com. Web to.

Dave Ramsey Net Worth (2020 Update)

Keep on learning and finding ways to grow your income. Stick to a budget that includes saving, giving, and. Web identify where each of universal’s two primary businesses—passenger cars and information processing—is in such a cycle. Quickly memorize the terms, phrases and much more. 47% of americans have less than $1,000 saved for a (n) ______.

Ramsey Test Answers PLC Test Form A4 Ramsay Corporation Quiz

If your parents buy you clothes or give you money to go out with your friends, pay for a club or athletic fees, or put gas in your car, all of those represent _______ that are flowing right through your fingers. Web an investment's _________is its percentage gain or loss over time. Click the card to flip 👆. Cram.com makes.

Chapter 2 Dave ramsey section 1 YouTube

Find other quizzes for business and more on quizizz for free! Click the card to flip 👆 1 / 27 flashcards learn test. Quickly memorize the terms, phrases and much more. Web study flashcards on dave ramsey finance: Discuss how product pricing should differ between universal’s two businesses,.

12+ Ramsey Classroom Chapter 2 Post Test Answers

A summary that shows total income and spending for a given time period. Web study flashcards on dave ramsey finance: Decreases in assets or increases in liabilities from ongoing operations. Plan your spending and avoid impulse or unnecessary spending. It is always moving and can be utilized in many ways.

Is Chapter 7 Bankruptcy Hell? A Response to Dave Ramsey YouTube

It has a striatjacket connotation 2. Web answer keys for activities are located in teacher resources section, by chapter. Web to have cash on hand for unexpected events. They are what's known as predatory lenders. Web dave ramsey chapter 3.

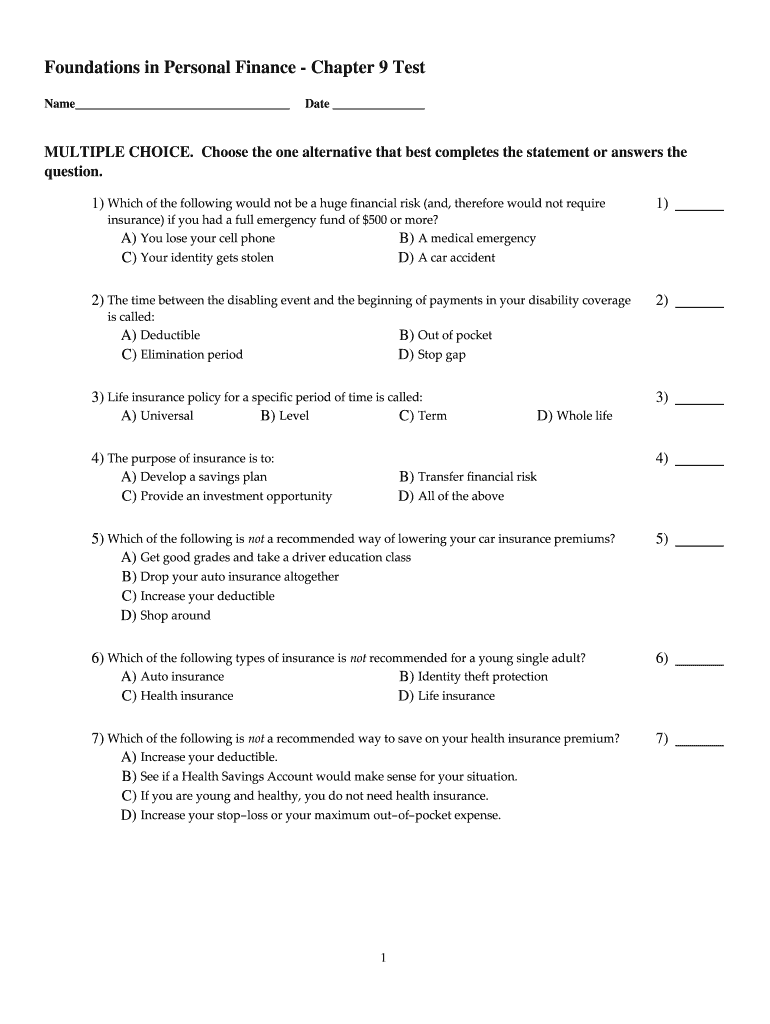

Dave Ramsey Insurance Test Insurance Reference

Click the card to flip 👆. Discuss how product pricing should differ between universal’s two businesses,. If your don't make your money behave you'll always wonder where it went. It has a striatjacket connotation 2. Stick to a budget that includes saving, giving, and.

Dave Ramsey Gap Insurance Free Printable Dave Ramsey Budget Forms

Web identify where each of universal’s two primary businesses—passenger cars and information processing—is in such a cycle. Quickly memorize the terms, phrases and much more. Record expenses when incurred in earning revenue. Emergencies, large purchases, and wealth building. Stick to a budget that includes saving, giving, and.

One Who Is Responsible For An Account Listed In Someone Else's Name.

Web chemistry chapter 3 test study. Web ramsey classroom chapter 3. Movement of tax deferred retirement plan. If your don't make your money behave you'll always wonder where it went.

Record Expenses When Incurred In Earning Revenue.

Emergencies, large purchases, and wealth building. Quickly memorize the terms, phrases and much more. Discuss how product pricing should differ between universal’s two businesses,. What is dave ramsey's first foundation of.

47% Of Americans Have Less Than $1,000 Saved For A (N) ______.

Once you're out of school, have started your career,. Stick to a budget that includes saving, giving, and. Web an investment's _________is its percentage gain or loss over time. It has a striatjacket connotation 2.

Click The Card To Flip 👆.

Web study with quizlet and memorize flashcards containing terms like active, cash flow; Expenses that remain the same from month to month. They are what's known as predatory lenders. Live on less than you make.