Chapter 13 Return Risk And The Security Market Line Solutions

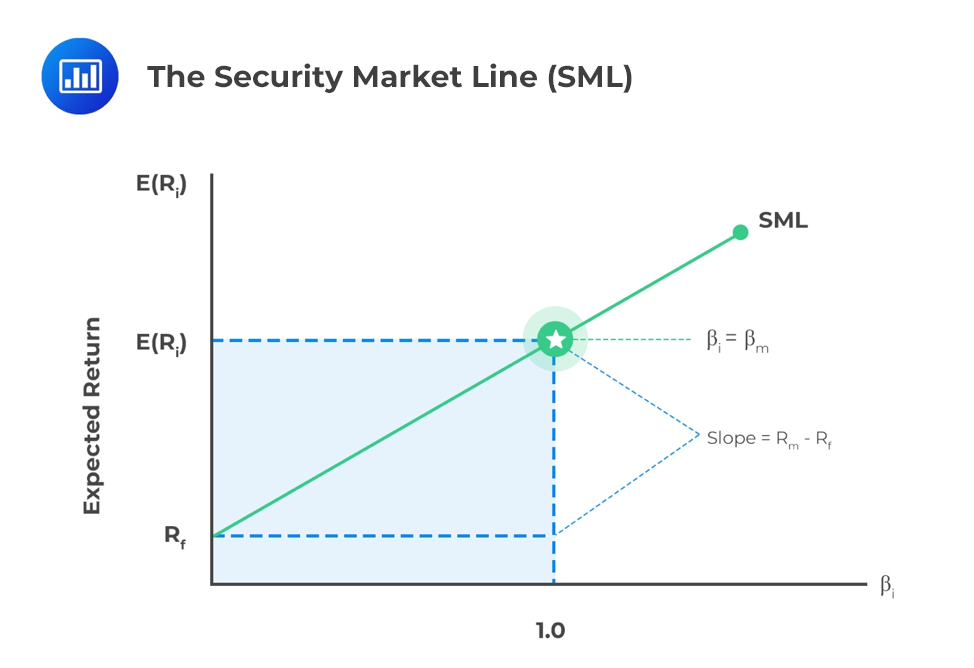

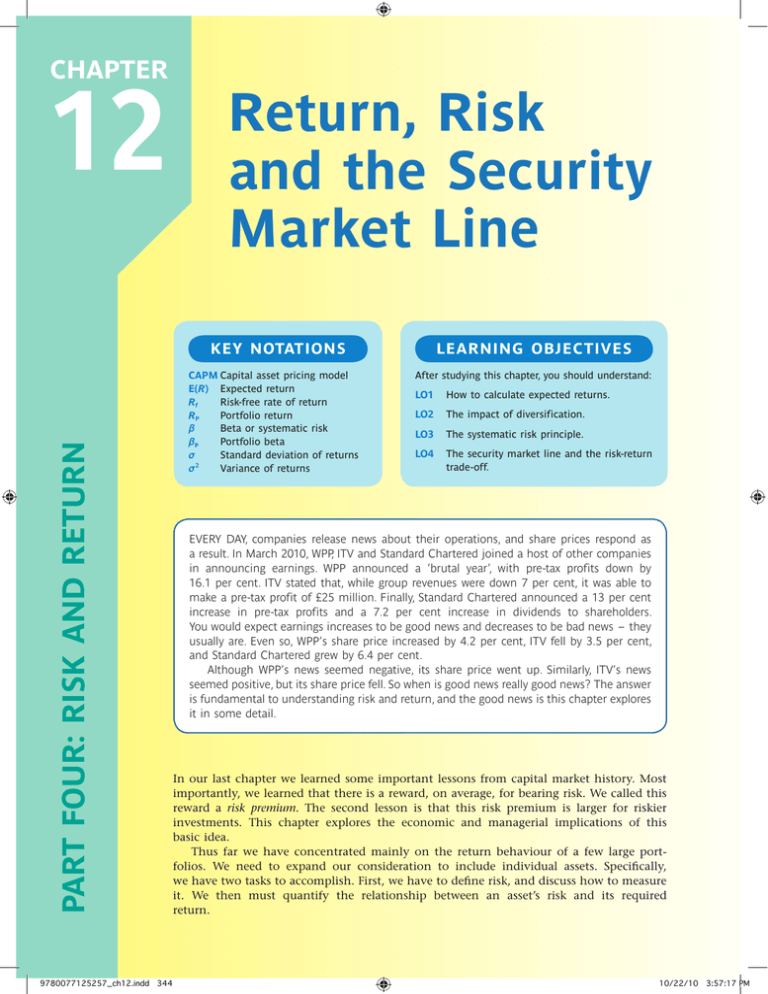

Chapter 13 Return Risk And The Security Market Line Solutions - Web a collection of assets. Web return, risk, and the security market line. Web a measure of the degree to which returns on two risky assets move in tandem. Show how to calculate expected returns, variance, and standard deviation.2. Web return, risk, and the security market line learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification and the role of correlation. Definition & uses discover how to relate beta to the security market line to aid in asset evaluation. Ipod content (chapter content) after studying this chapter… The calculation for expected returns and standard deviation for individual securities and portfolios. Return, risk, and the security market line what does variance measure? By investing in a variety of.

Return, risk, & the security market line 4 lessons in chapter 12: Create flashcards for free and quiz yourself with an interactive flipper. Answers to concepts review and critical thinking questions. Premium content on this olc includes: 1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b. Discuss the impact of dive. The calculation for expected returns and standard deviation for individual securities and portfolios. Web return, risk, and the security market line. The risk return trade off is measured by the portfolio expected return and sd efficient market a result of investors trading on the unexpected portion of announcements.

The risk return trade off is measured by the portfolio expected return and sd efficient market a result of investors trading on the unexpected portion of announcements. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. The calculation for expected returns and standard deviation for individual securities and portfolios. 1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b. Web return, risk, and the security market line. The principle of diversification and the role of correlation. Show how to calculate expected returns, variance, and standard deviation.2. By investing in a variety of. Beta as a measure of risk and the security market line. Discuss the impact of dive.

Chapter 13 return risk security market line Chapter 13 Return, Risk

If the economy goes into a recessionary period, then rtf is expected to only return. Web chapter 13 risk, return, and the security market line. Some of the risk in holding any asset is unique to the asset in question. Web the security market line: Web about press copyright contact us creators advertise developers terms privacy policy & safety how.

Managerial Finance Chapter 13—Return, Risk & the Security Market Line

Web only $35.99/year social science economics finance chapter 13 flashcards learn test match flashcards learn test match created by latriciafry return, risk and the security market line terms in this set (12) expected return the return. Web chapter 13 risk, return, and the security market line. Web catch the top stories of the day on anc’s ‘top story’ (18 august.

Calculating Returns using CAPM CFA Level 1 AnalystPrep

Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. 4 lessons in chapter 12: The principle of diversification and the role of correlation. Web only $35.99/year social science economics finance chapter 13 flashcards learn test match flashcards learn test match created by latriciafry return,.

Risk, Return, and the Security Market Line

Web return, risk, and the security market line. Show how to calculate expected returns, variance, and standard deviation.2. If the expected returns on these stocks are 11 percent and 15 percent, respectively, what is the expected return. Web performance auto company, whose tax rate is 40% has two sources of funds: Web chapter 13 return, risk, and the security market.

Chapter 13 return risk security market line Chapter 13 Return, Risk

If the economy goes into a recessionary period, then rtf is expected to only return. Web a collection of assets. Web after studying this chapter, you should be able to: Beta as a measure of risk and the security market line. Web return, risk, and the security market line learning objectives lo1lo2 the calculation for expected returns and standard deviation.

Chapter 13 Return & Risk (Part 9) YouTube

4 lessons in chapter 12: Show how to calculate expected returns, variance, and standard deviation.2. Ipod content (chapter content) after studying this chapter… Web a measure of the degree to which returns on two risky assets move in tandem. Web return, risk, and the security market line to learn more about the book this website supports, please visit its information.

PPT Risk, Return, and Security Market Line PowerPoint Presentation

Web return, risk, and the security market line. Web return, risk, and the security market line learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification and the role of correlation. Some of the risk in holding any asset is unique to the asset in question. Definition & uses discover how to.

Chapter 13 Return & Risk (Part 3) YouTube

Answers to concepts review and critical thinking questions. Beta as a measure of risk and the security market line. Return, risk, & the security market line Discuss the impact of dive. Show how to calculate expected returns, variance, and standard deviation.2.

12 Return, Risk and the Security Market Line

Premium content on this olc includes: Given the probabilities of each. Web ariannabassil terms in this set (13) what is an expected return? Web return, risk, and the security market line. 1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b.

CHAPTER 13 RETURN, RISK, AND THE SECURITY MARKET LINE

1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b. Web return, risk, and the security market line. Best guess of what will happen in the future based on possibilities the return on a risky asset expected in the future unexpected return what you actually earn minus expected return. Web catch the top.

Web Return, Risk, And The Security Market Line To Learn More About The Book This Website Supports, Please Visit Its Information Center.

The risk return trade off is measured by the portfolio expected return and sd efficient market a result of investors trading on the unexpected portion of announcements. Answers to concepts review and critical thinking questions. Some of the risk in holding any asset is unique to the asset in question. Web return, risk, and the security market line.

Web Return, Risk, And The Security Market Line.

Web a measure of the degree to which returns on two risky assets move in tandem. Create flashcards for free and quiz yourself with an interactive flipper. Definition & uses discover how to relate beta to the security market line to aid in asset evaluation. By investing in a variety of.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (18 August 2023)

Return, risk, & the security market line Web performance auto company, whose tax rate is 40% has two sources of funds: Best guess of what will happen in the future based on possibilities the return on a risky asset expected in the future unexpected return what you actually earn minus expected return. Web chapter 13 risk, return, and the security market line.

1.You Own A Portfolio That Has $2,500 Invested In Stock A And $3,600 Invested In Stock B.

Learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification. Premium content on this olc includes: Web a collection of assets. Web chapter 13 return, risk, and the security market line.