Chapter 13 Bankruptcy Repossession

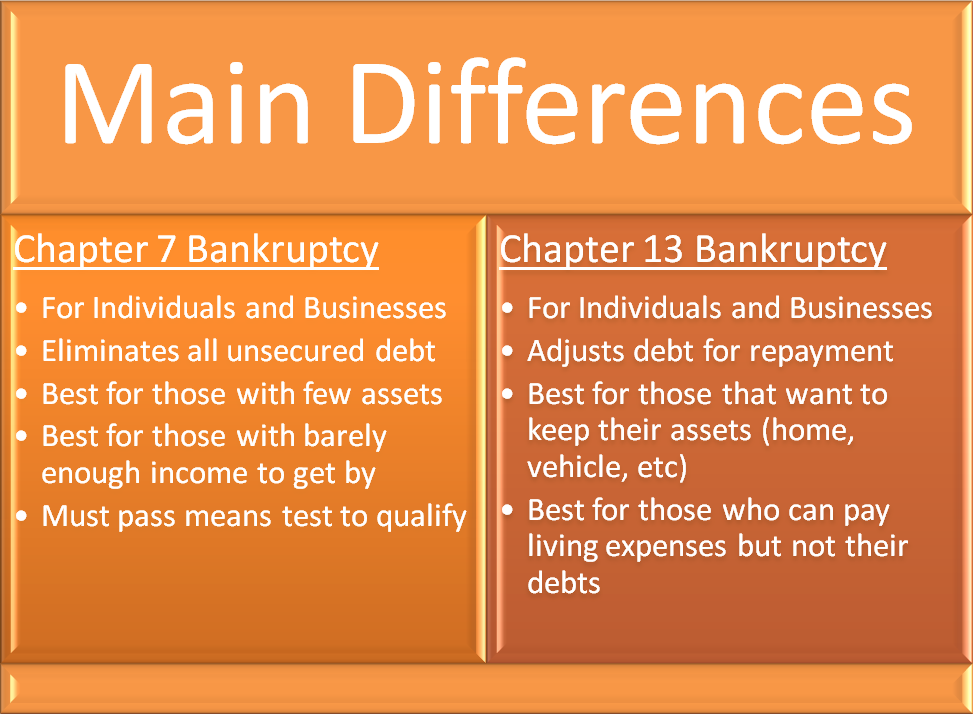

Chapter 13 Bankruptcy Repossession - Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. We can explain when you should file a proof of claim on behalf of creditors and answer other questions you may have throughout your case. Web what is chapter 13 bankruptcy? Web what is chapter 13 bankruptcy and how can it help prevent vehicle repossession? All chapter 13 plans must be signed by the debtor and are subject to local bankruptcy. Web the automatic stay prevents a lender from selling the vehicle, and the chapter 13 debtor is authorized under the turnover section of the bankruptcy code to seek to reclaim possession of the vehicle. Web both chapter 7 and chapter 13 bankruptcy provide useful tools that may make avoiding repossession possible. Chapter 13 bankruptcy, commonly known as a wage earner’s plan, presents a lifeline to individuals seeking to reorganize their debts and create a manageable repayment strategy. This rule is deleted to allow a trustee to manage the. Where a debtor has valuable nonexempt property and wants to keep it, a chapter 13.

Web a charge off and a repossession are two very different things—although both could happen to one debt. If your lender is suing you for a deficiency balance, filing for bankruptcy relief can stop the lawsuit. All chapter 13 plans must be signed by the debtor and are subject to local bankruptcy. This allows a bankruptcy filer to keep their car by preventing the car loan from being discharged in the bankruptcy. Kentucky residents might be relieved to learn that a chapter 13 bankruptcy. Web let's be clear, filing a chapter 13 bankruptcy isn't the best way to avoid auto repossession. How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court. Web a chapter 13 bankruptcy allows them to make up their overdue payments over time and to reinstate the original agreement. Web in chapter 13, you might have an option called the cramdown by which you repay the lender the market value of your vehicle instead of what you actually owe on the loan. Web to keep your home in chapter 13, you must stay current on your mortgage.

This allows a bankruptcy filer to keep their car by preventing the car loan from being discharged in the bankruptcy. Web what is chapter 13 bankruptcy and how can it help prevent vehicle repossession? Entering into a reaffirmation agreement can lead to new debt problems if you default on your car loan payments after bankruptcy. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. This rule is deleted to allow a trustee to manage the. Web chapter 13 and vehicle repossession filing for bankruptcy does not always mean that a person has to surrender all his or her assets, including a new car. Where a debtor has valuable nonexempt property and wants to keep it, a chapter 13. Or you can contact us online and schedule your free chapter 13 bankruptcy consultation. Web a chapter 13 bankruptcy allows them to make up their overdue payments over time and to reinstate the original agreement. Certain debts are nondischareable in bankruptcy.

Chapter 7 Bankruptcy vs Chapter 13 Bankruptcy Arizona Bankruptcy

To learn more about this option, see car loan cramdowns in bankruptcy. Take inventory of the property you have. A chapter 7 or chapter 13 bankruptcy discharge can eliminate. One tool is a reaffirmation agreement in a chapter 7 case. This will prevent foreclosure and/or property repossession.

Cost of filing Chapter 13 bankruptcy A quick overview Galler Law Firm

A chapter 13 plan must conform to local bankruptcy form m. In this article, you'll learn what each term means, as well as how the bankruptcy court handles these events in chapter 7 and chapter 13 bankruptcy. Entering into a reaffirmation agreement can lead to new debt problems if you default on your car loan payments after bankruptcy. A chapter.

The Chapter 13 Discharge Chapter 13 Bankruptcy Attorney

Web attorney fees (collectively referred to as “safe harbor fees”) incurred by lawyers representing secured creditors shall be presumed reasonable in chapter 13 cases if such fees are timely. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. Contrary to chapter 7.

How Long Does Chapter 13 Bankruptcy Take in &

Web let's be clear, filing a chapter 13 bankruptcy isn't the best way to avoid auto repossession. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. Web a charge off and a repossession are two very different things—although both could happen to.

Chapter 13 Bankrutpcy Will Prevent Repossession Of Your Vehicle

It does temporarily prevent repossession with an automatic stay, but you still have to pay your car loan. Web in chapter 13, you might have an option called the cramdown by which you repay the lender the market value of your vehicle instead of what you actually owe on the loan. Web both chapter 7 and chapter 13 bankruptcy provide.

BANKRUPTCY BASICS PART 7 CHAPTER 13 Chapter 7 & Chapter 13

Entering into a reaffirmation agreement can lead to new debt problems if you default on your car loan payments after bankruptcy. This rule is deleted to allow a trustee to manage the. Repayment of the loan is dealt with later in the bankruptcy case in the debtor’s chapter 13. Take inventory of the property you have. Web a charge off.

Things NOT to Do Before Filing for Bankruptcy Loan Lawyers

This will prevent foreclosure and/or property repossession. Chapter 13 bankruptcy, commonly known as a wage earner’s plan, presents a lifeline to individuals seeking to reorganize their debts and create a manageable repayment strategy. This rule is deleted to allow a trustee to manage the. Web in a nutshell you have options for what to do with a car loan when.

Chapter 7 Bankruptcy Do you qualify, how to file

Web the automatic stay prevents a lender from selling the vehicle, and the chapter 13 debtor is authorized under the turnover section of the bankruptcy code to seek to reclaim possession of the vehicle. A chapter 13 plan must conform to local bankruptcy form m. How you pay your mortgage will depend on whether you've fallen behind and the rules.

Chapter 13 bankruptcy explained YouTube

Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. Web chapter 13 and vehicle repossession filing for bankruptcy does not always mean that a person has to surrender all his or her assets, including a new car. Web both chapter 7 and.

Five Tips On Getting Your Car Back After A Repossession Brine

Web if your automobile is repossessed before you file a chapter 13 bankruptcy, the creditor will need to return the vehicle to you in most situations. Repayment of the loan is dealt with later in the bankruptcy case in the debtor’s chapter 13. Web to keep your home in chapter 13, you must stay current on your mortgage. Web in.

This Will Prevent Foreclosure And/Or Property Repossession.

Web in a nutshell you have options for what to do with a car loan when filing a chapter 7 case, including reaffirmation, redemption, or surrender. Chapter 13 bankruptcy, commonly known as a wage earner’s plan, presents a lifeline to individuals seeking to reorganize their debts and create a manageable repayment strategy. Certain debts are nondischareable in bankruptcy. How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court.

Entering Into A Reaffirmation Agreement Can Lead To New Debt Problems If You Default On Your Car Loan Payments After Bankruptcy.

Kentucky residents might be relieved to learn that a chapter 13 bankruptcy. Web if your automobile is repossessed before you file a chapter 13 bankruptcy, the creditor will need to return the vehicle to you in most situations. All chapter 13 plans must be signed by the debtor and are subject to local bankruptcy. Web a chapter 13 bankruptcy attorney can help make sure this does not happen.

Web A Chapter 13 Bankruptcy Allows Them To Make Up Their Overdue Payments Over Time And To Reinstate The Original Agreement.

Web in chapter 13, you might have an option called the cramdown by which you repay the lender the market value of your vehicle instead of what you actually owe on the loan. Or you can contact us online and schedule your free chapter 13 bankruptcy consultation. A chapter 7 or chapter 13 bankruptcy discharge can eliminate. Web a charge off and a repossession are two very different things—although both could happen to one debt.

In Some Chapter 13 Scenarios, A Case Is Filed Right After A Repossession.

What are the steps to filing a chapter 13 bankruptcy? This allows a bankruptcy filer to keep their car by preventing the car loan from being discharged in the bankruptcy. It does temporarily prevent repossession with an automatic stay, but you still have to pay your car loan. We can explain when you should file a proof of claim on behalf of creditors and answer other questions you may have throughout your case.