Chapter 13 Bankruptcy Limits

Chapter 13 Bankruptcy Limits - Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but provides. On the date you file your chapter 13 bankruptcy petition, your debts cannot exceed these amounts or you cannot qualify for chapter 13. For additional tax information on bankruptcy, refer to publication 908, bankruptcy tax guide and publication 5082, what you should know about chapter 13 bankruptcy. Adults with unsecured debts of less than $465,275 and secured debts of less than $1,395,875 can seek protection by chapter 13. If your total debt burden is too high, you'll be ineligible, but you can file an individual chapter 11 bankruptcy. Web effective april 1, 2019, and effective for three (3) years, the applicable debt limits for chapter 13 cases are: Individuals may also file under chapter 7 or chapter 11. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. • $1,257,850 in secured debts; Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025.

Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. Web therefore, the current chapter 13 debt limits effective for 2020 are as follows: If your total debt burden is too high, you'll be ineligible, but you can file an individual chapter 11 bankruptcy. But not everyone is eligible. Web chapter 13 plans are usually three to five years in length and may not exceed five years. For those who don’t know, secured debts are those that are secured against some form of. Individuals may also file under chapter 7 or chapter 11. And, • $419,275 in unsecured debts. Adults with unsecured debts of less than $465,275 and secured debts of less than $1,395,875 can seek protection by chapter 13.

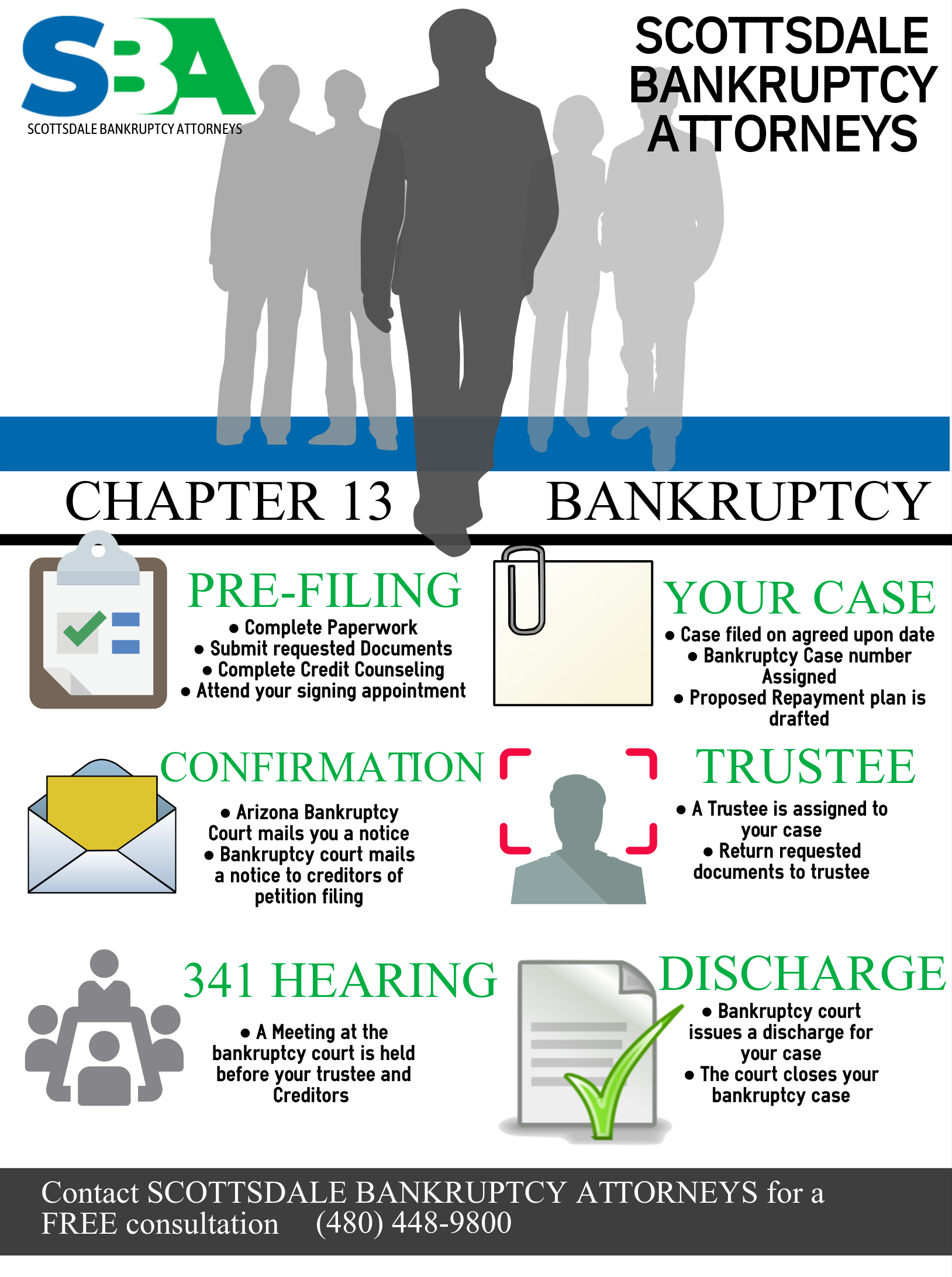

Web chapter 13 plans are usually three to five years in length and may not exceed five years. Individuals may also file under chapter 7 or chapter 11. But not everyone is eligible. Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025. Web individuals may file chapter 7 or chapter 13 bankruptcy, depending on the specifics of their situation. Web effective april 1, 2019, and effective for three (3) years, the applicable debt limits for chapter 13 cases are: Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. The limit amounts change every three years. Up to five years for chapter 13… Chapter 7, you may still be eligible to file under chapter 13.

JC White Law Group Chapter 7 or Chapter 13 Bankruptcy Which is Right

Web there's no limit to how many times you can file for bankruptcy, but there is a limit on how often you can file for bankruptcy. The limit amounts change every three years. For additional tax information on bankruptcy, refer to publication 908, bankruptcy tax guide and publication 5082, what you should know about chapter 13 bankruptcy. Web therefore, the.

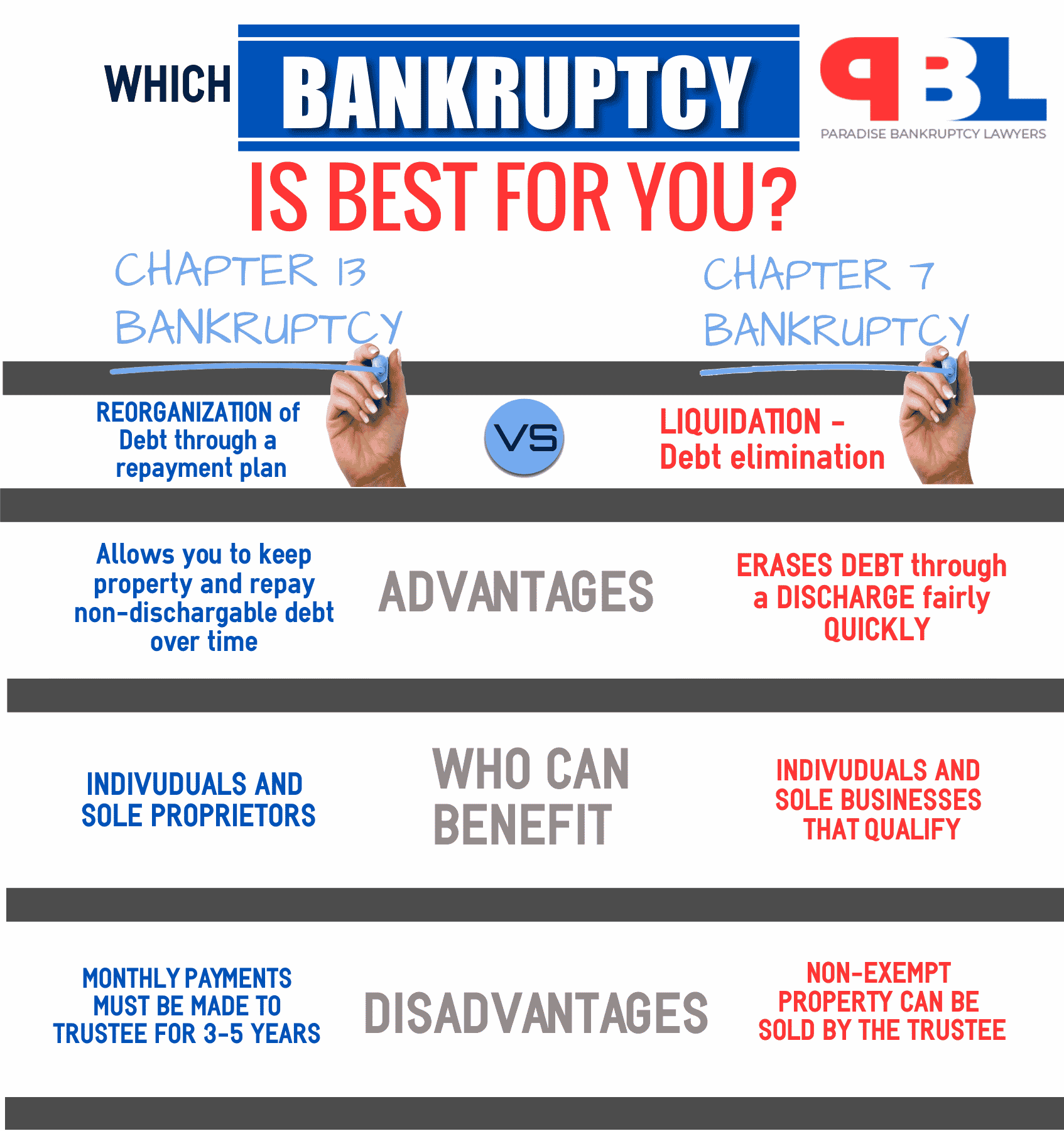

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

§ 109 (e).” everyone who files for chapter 13. It's more likely that a chapter 13 debtor will have a problem with. Debtors have the option of filing a chapter 13 bankruptcy as long as some qualifications are met. For those who don’t know, secured debts are those that are secured against some form of. Businesses may file bankruptcy under.

Chapter 13 Bankruptcy Debt Limits Steiner Law Group

Web chapter 13 comes with debt limits, as well. Web individuals may file chapter 7 or chapter 13 bankruptcy, depending on the specifics of their situation. For additional tax information on bankruptcy, refer to publication 908, bankruptcy tax guide and publication 5082, what you should know about chapter 13 bankruptcy. Web until today, 11 usc §109 (e) limited the eligibility.

What Is Chapter 13 Bankruptcy and Is It Worth It? TheStreet

Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web you can have only so much debt in chapter 13 bankruptcy—you'll find the.

Chapter 13 Debt Limits Learn About Them Easy Debt Management

For those who don’t know, secured debts are those that are secured against some form of. On the date you file your chapter 13 bankruptcy petition, your debts cannot exceed these amounts or you cannot qualify for chapter 13. To qualify for chapter 13, your debt must be under the limit set by the bankruptcy. But not everyone is eligible..

2022 Chapter 13 Debt Ceiling Increase Tejes Law, PLLC Orlando Based

Learn more about chapter 13 bankruptcy, including who can and can't file this bankruptcy. Chapter 7, you may still be eligible to file under chapter 13. $1,257,850 these chapter 13 debt limits adjust every 3 years under. To qualify for chapter 13, you must have regular income, have filed all required tax returns for tax periods ending within four years.

CHAPTER 11 BANKRUPTCY Zimmermann Law Office S.C.

• $1,257,850 in secured debts; Web chapter 13 plans are usually three to five years in length and may not exceed five years. Web you can have only so much debt in chapter 13 bankruptcy—you'll find the chapter 13 bankruptcy debt limitations here. Web state and federal bankruptcy exemptions for people filing chapter 7 bankruptcy or chapter 13 bankruptcy —.

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

• $1,257,850 in secured debts; Individuals may also file under chapter 7 or chapter 11. $1,257,850 these chapter 13 debt limits adjust every 3 years under. Web there's no limit to how many times you can file for bankruptcy, but there is a limit on how often you can file for bankruptcy. Web it has provisions that allow an individual.

10 Reasons People File Chapter 13 Bankruptcy Callahan Law Firm

Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but provides. Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web what are the chapter 13 debt limits? Under sb 3823, debtors no longer are required to limit. Web you can have only.

Chapter 13 bankruptcy explained YouTube

Web there's no limit to how many times you can file for bankruptcy, but there is a limit on how often you can file for bankruptcy. Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025. Individuals may also file under chapter 7.

For Those Who Don’t Know, Secured Debts Are Those That Are Secured Against Some Form Of.

• $1,257,850 in secured debts; Web there's no limit to how many times you can file for bankruptcy, but there is a limit on how often you can file for bankruptcy. Up to five years for chapter 13… Rather, the courts will see if your income is too low to.

Unlike Chapter 7 Bankruptcy, There Is No Means Testto See Whether Your Income Is Too High To File For A Chapter 13 Bankruptcy.

Web therefore, the current chapter 13 debt limits effective for 2020 are as follows: Web it has provisions that allow an individual with regular income to repay some creditors less than the amount owed while keeping all assets, including houses and cars. Municipalities—cities, towns, villages, taxing districts, municipal utilities, and school districts may file under chapter 9 to reorganize. Web what are the chapter 13 debt limits?

And, • $419,275 In Unsecured Debts.

Debtor’s secured and unsecured debt amounts cannot exceed the limits set for a chapter 13. $1,257,850 these chapter 13 debt limits adjust every 3 years under. Businesses may file bankruptcy under chapter 7 to liquidate or chapter. Debtors have the option of filing a chapter 13 bankruptcy as long as some qualifications are met.

Web No Income Limits.

If your total debt burden is too high, you'll be ineligible, but you can file an individual chapter 11 bankruptcy. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. On the date you file your chapter 13 bankruptcy petition, your debts cannot exceed these amounts or you cannot qualify for chapter 13. Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for.