Chapter 13 Accounting Test Answers

Chapter 13 Accounting Test Answers - Web chapter 13 current liabilities and contingencies. The form that is prepared and sent with the employer's check to. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. The employees payroll taxes are operating expenses of the business. 1 discuss the basic business activities and related information. Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. Market prospects general purpose financial statements a type of financial accounting. Warfield (16e) chapter 13 current liabilities and contingencies (do not round intermediate calculations and round your final percentage answers to 1. Web 1.2 distinguish between financial and managerial accounting;

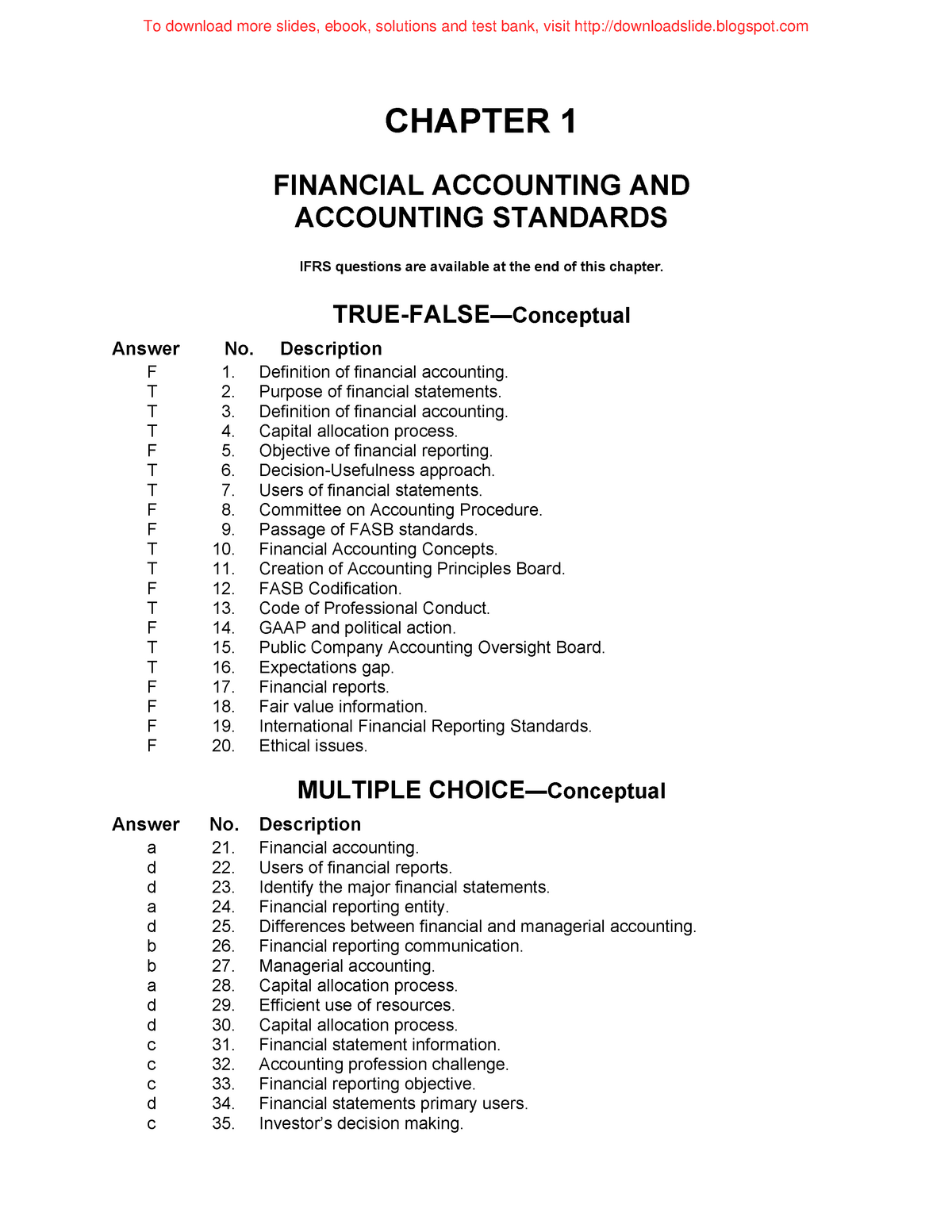

Web chapter 13 solution for intermediate accounting by donald e. Web connect managerial accounting chapter 13 | online class help. (d) transferred out to next department (100%) 55,000 normal lost. Click the card to flip 👆 true 1 / 25 flashcards created by. Web test bank chapter 13 property transactions: Salaries payable click the card to flip 👆 b. Ifrs questions are available at the end of this chapter. Click the card to flip 👆. Web fill accounting chapter 13 test a answers, edit online. Web 4.4 (7 reviews) which of the following is not an example of a current liability?

Web chapter 13 current liabilities and contingencies. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. 1.3 explain the primary roles and skills required of managerial accountants; Guidelines (rules of thumb) intracompany the company current performance is compared to its prior performance and its relations between financial items competitors. Web fill accounting chapter 13 test a answers, edit online. Web test bank chapter 13 property transactions: Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Sign, fax and printable from pc, ipad, tablet or mobile with. Click the card to flip 👆 true 1 / 25 flashcards created by. Ifrs questions are available at the end of this chapter.

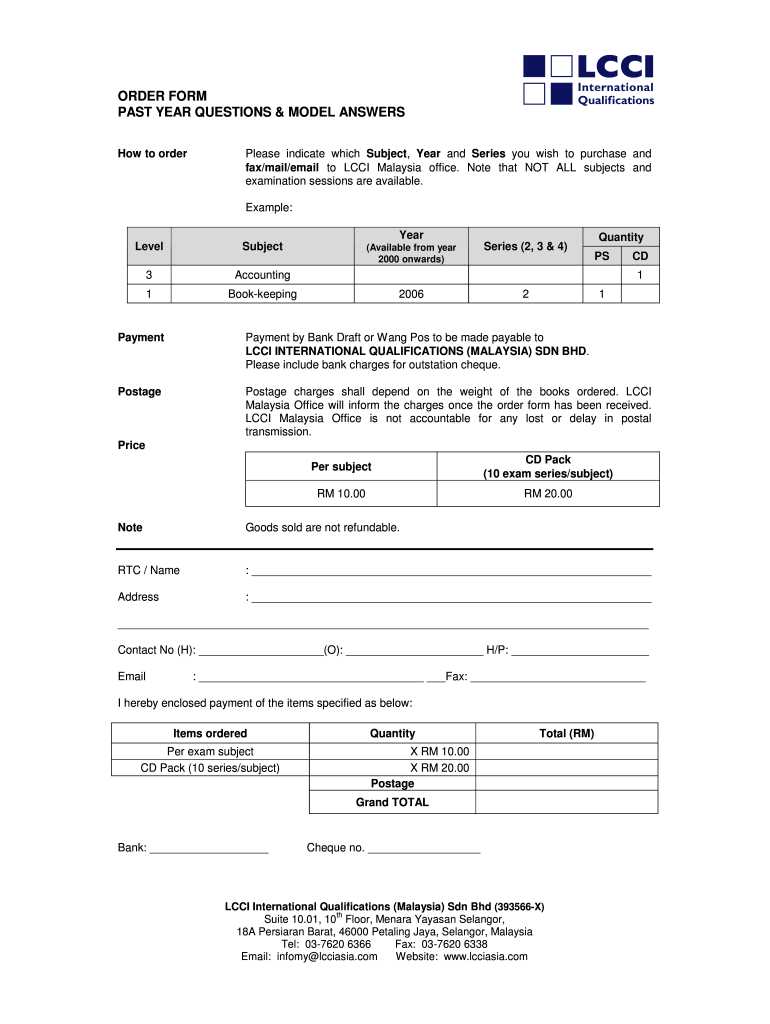

Lcci Level 3 Past Year Questions And Model Answers Fill Online

Click the card to flip 👆 true 1 / 25 flashcards created by. Web chapter 13 current liabilities and contingencies. Web connect managerial accounting chapter 13 | online class help. Guidelines (rules of thumb) intracompany the company current performance is compared to its prior performance and its relations between financial items competitors. The analysis of financial statements is done for.

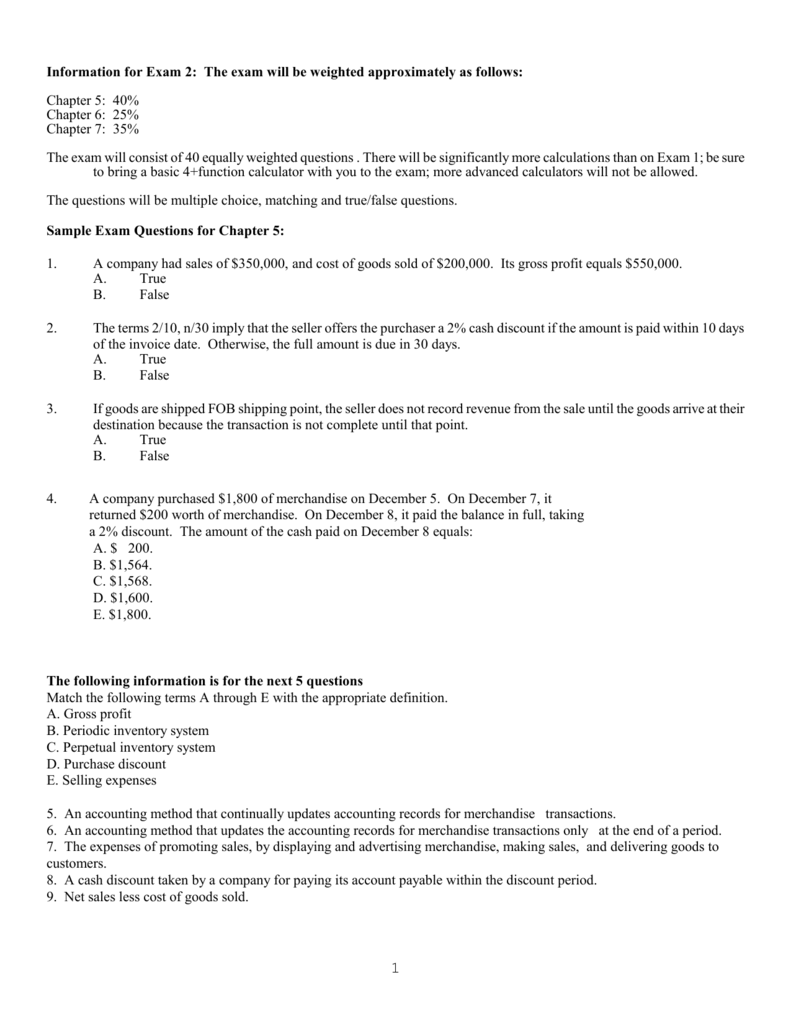

Chapter 6 Study Guide Accounting True And False Study Poster

1.4 describe the role of the institute of management accountants and the use of ethical standards; Web fill accounting chapter 13 test a answers, edit online. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Unemployment tax rate is greater than the state unemployment. Click the card to flip 👆 salaries expense.

Accounting basics and interview questions answers

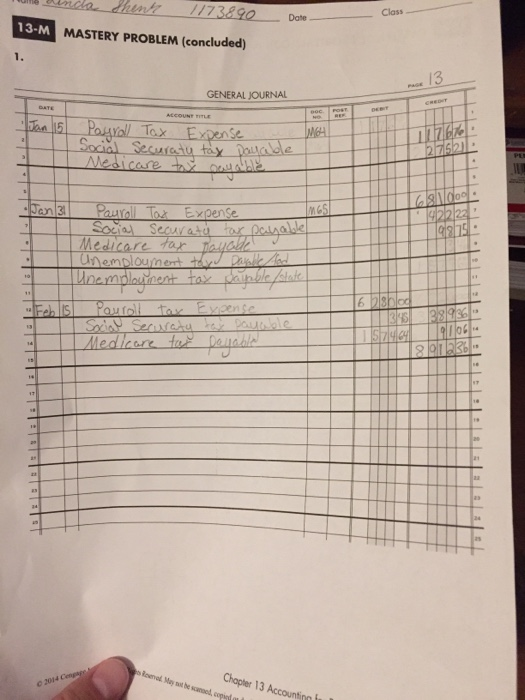

Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. Click the card to flip 👆. Click the card to flip 👆 true 1 / 25 flashcards created by. Determination of gain or loss, basis considerations, and nontaxable exchanges 1473. 1.3 explain the.

I am doing accounting test which is 8 test from ashworth college do you

Click the card to flip 👆 salaries expense is debited click the card to flip 👆 1 / 30 flashcards learn test match created. Web connect managerial accounting chapter 13 | online class help. Web study with quizlet and memorize flashcards containing terms like the ss tax is paid by both the employer and employees., the fed. Web accounting chapter.

Chapter 13 Payroll Liabilities And Tax Records Study Guide Answers

Warfield (16e) chapter 13 current liabilities and contingencies Click the card to flip 👆. Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: 1.5 describe trends in today’s business environment and analyze their impact on accounting… Sign, fax and printable from pc, ipad, tablet or mobile with.

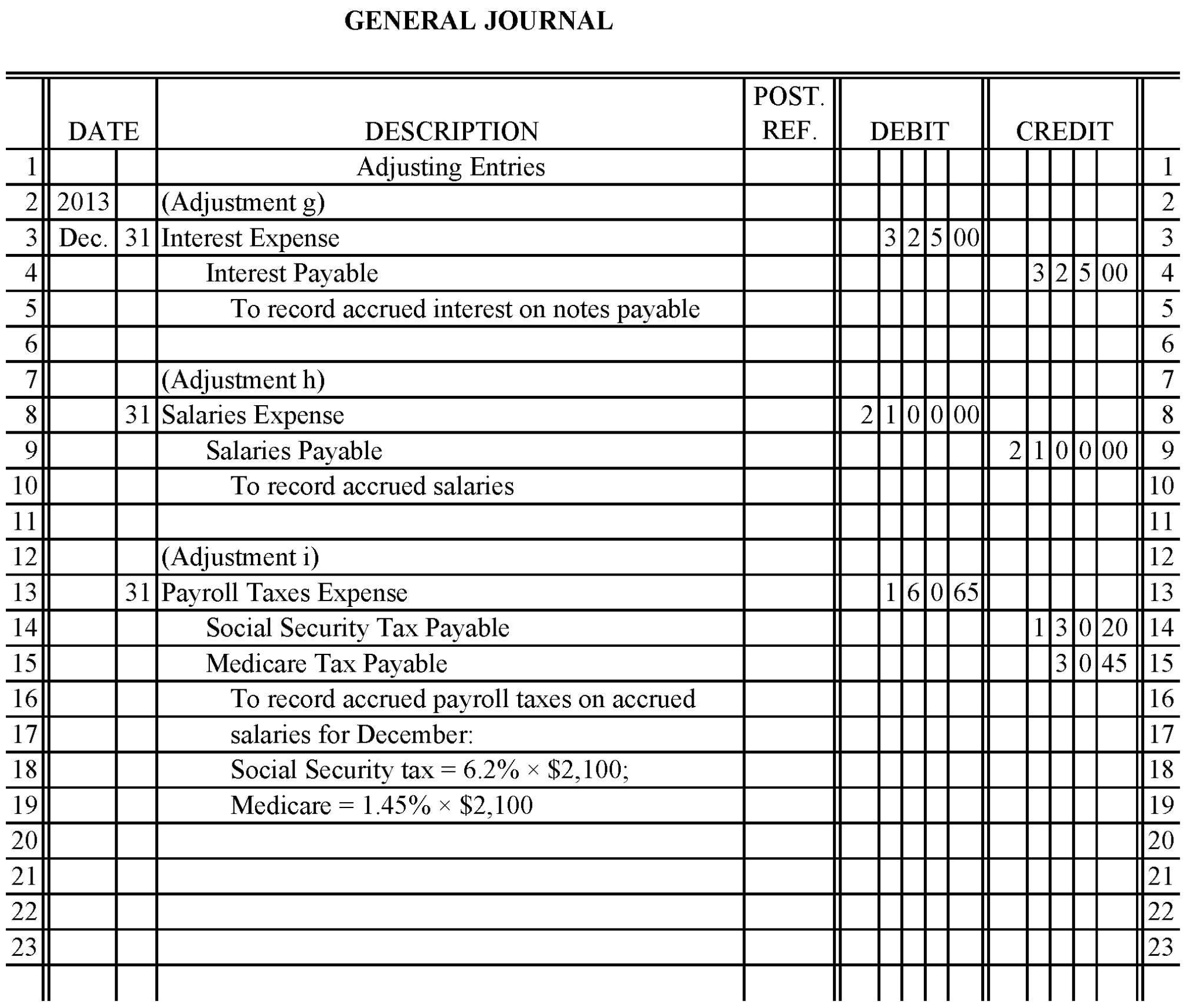

Solved Accounting Principles I1 Study Guide For Exam 3

Web chapter 13 solution for intermediate accounting by donald e. Web fill accounting chapter 13 test a answers, edit online. Web study with quizlet and memorize flashcards containing terms like the ss tax is paid by both the employer and employees., the fed. Guidelines (rules of thumb) intracompany the company current performance is compared to its prior performance and its.

Grade 13 Accounting Gihan

Web chapter 13 current liabilities and contingencies. Sign, fax and printable from pc, ipad, tablet or mobile with. Click the card to flip 👆 true 1 / 25 flashcards created by. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. The analysis.

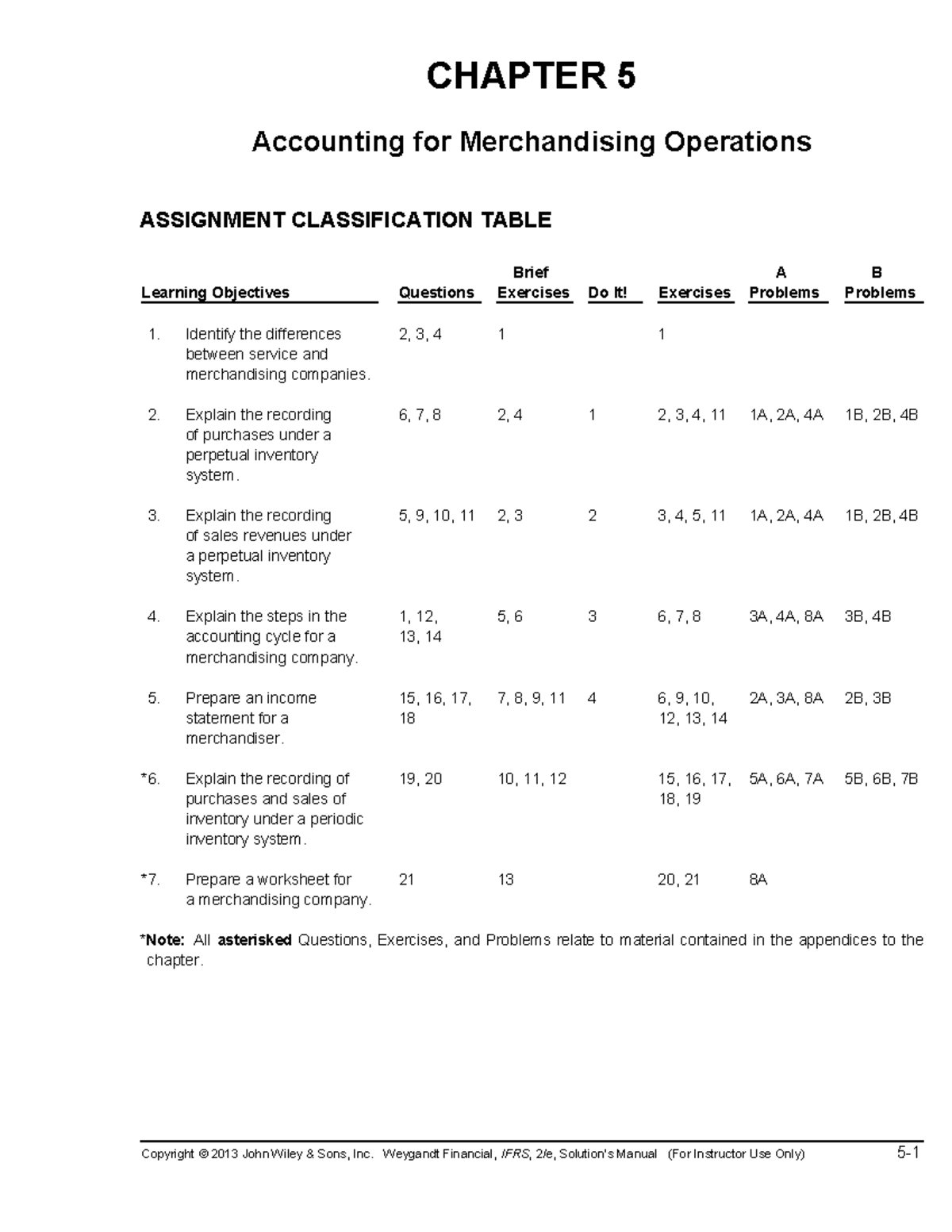

Ch05solutions Accounting Principles 13th Edition chapter 5 solutions

Web test bank chapter 13 property transactions: Click the card to flip 👆. Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. The analysis.

Chapter 13 Payroll Liabilities And Tax Records Study Guide Answers

The form that is prepared and sent with the employer's check to. Web chapter 13 solution for intermediate accounting by donald e. 1.3 explain the primary roles and skills required of managerial accountants; Web 4.4 (7 reviews) which of the following is not an example of a current liability? Market prospects general purpose financial statements a type of financial accounting.

Chapter 1 Test Bank Financial Accounting MIS101 DU StuDocu

Web 1.2 distinguish between financial and managerial accounting; 1.3 explain the primary roles and skills required of managerial accountants; Sign, fax and printable from pc, ipad, tablet or mobile with. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. Ifrs questions are.

Unemployment Tax Rate Is Greater Than The State Unemployment.

Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. Web connect managerial accounting chapter 13 | online class help. Market prospects general purpose financial statements a type of financial accounting. Click the card to flip 👆 true 1 / 25 flashcards created by.

Web Chapter 13 Solution For Intermediate Accounting By Donald E.

Salaries payable click the card to flip 👆 b. Realized gain or loss is skip to document ask an expert Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Web chapter 13 current liabilities and contingencies.

Determination Of Gain Or Loss, Basis Considerations, And Nontaxable Exchanges 1473.

Guidelines (rules of thumb) intracompany the company current performance is compared to its prior performance and its relations between financial items competitors. Web study with quizlet and memorize flashcards containing terms like the ss tax is paid by both the employer and employees., the fed. 1 discuss the basic business activities and related information. Web 1.2 distinguish between financial and managerial accounting;

Click The Card To Flip 👆 Salaries Expense Is Debited Click The Card To Flip 👆 1 / 30 Flashcards Learn Test Match Created.

Of the following items, the only one which should not be classified as a current liability is a. 1.4 describe the role of the institute of management accountants and the use of ethical standards; Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. (d) transferred out to next department (100%) 55,000 normal lost.