Chapter 12 Payroll Accounting Working Papers Answers

Chapter 12 Payroll Accounting Working Papers Answers - Web ch.12 preparing payroll records paying employees wage: Use the tax withholding tables. Web 1 2 3 4 3. Web glencoe accounting chapter 12: Complete a payroll register for perez company. The date of payment is october 15. Web the amount of time for which an employee is paid. Web accounting ch 12 multiple choice flashcards | quizlet study with quizlet and memorize flashcards containing terms like employee. Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Find all the information it.

Use the tax withholding tables. Web accounting ch 12 multiple choice flashcards | quizlet study with quizlet and memorize flashcards containing terms like employee. Payroll accounting in this chapter: Web the amount of time for which an employee is paid. Web glencoe accounting chapter 12: An amount paid to an employee for every hour worked salary: Web study with quizlet and memorize flashcards containing terms like payroll, pay period, payroll check and more. Find all the information it. Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Web 1 2 3 4 3.

An amount paid to an employee for every hour worked salary: Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Web glencoe accounting chapter 12: Add hours reg and hours ot columns and enter the totals. Web ch.12 preparing payroll records paying employees wage: Web deduction an amount subtracted from an employee's gross earnings direct deposit the employer's deposit of net pay in an. Complete a payroll register for perez company. An amount subtracted from an employee's gross earnings. Web study with quizlet and memorize flashcards containing terms like payroll, pay period, payroll check and more. Use the tax withholding tables.

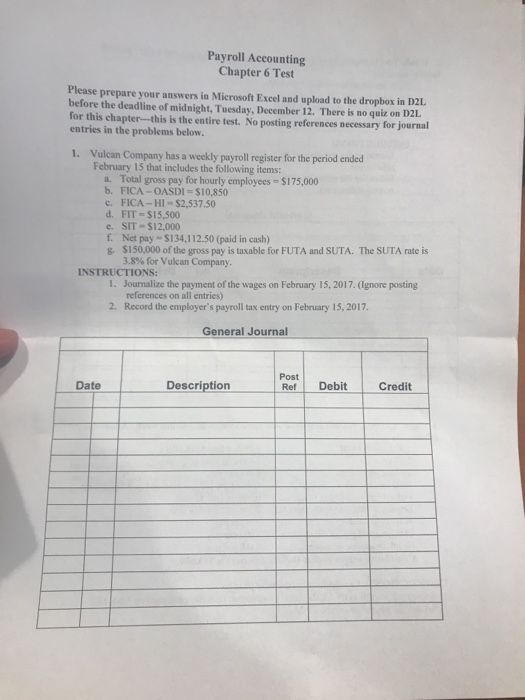

Solved Payroll Accounting Chapter 6 Test Please prepare your

Use the tax withholding tables. Add hours reg and hours ot columns and enter the totals. Web true a payroll register is prepared for each pay period true most businesses use computers to prepare the payroll true the. Web deduction an amount subtracted from an employee's gross earnings direct deposit the employer's deposit of net pay in an. Employee regular.

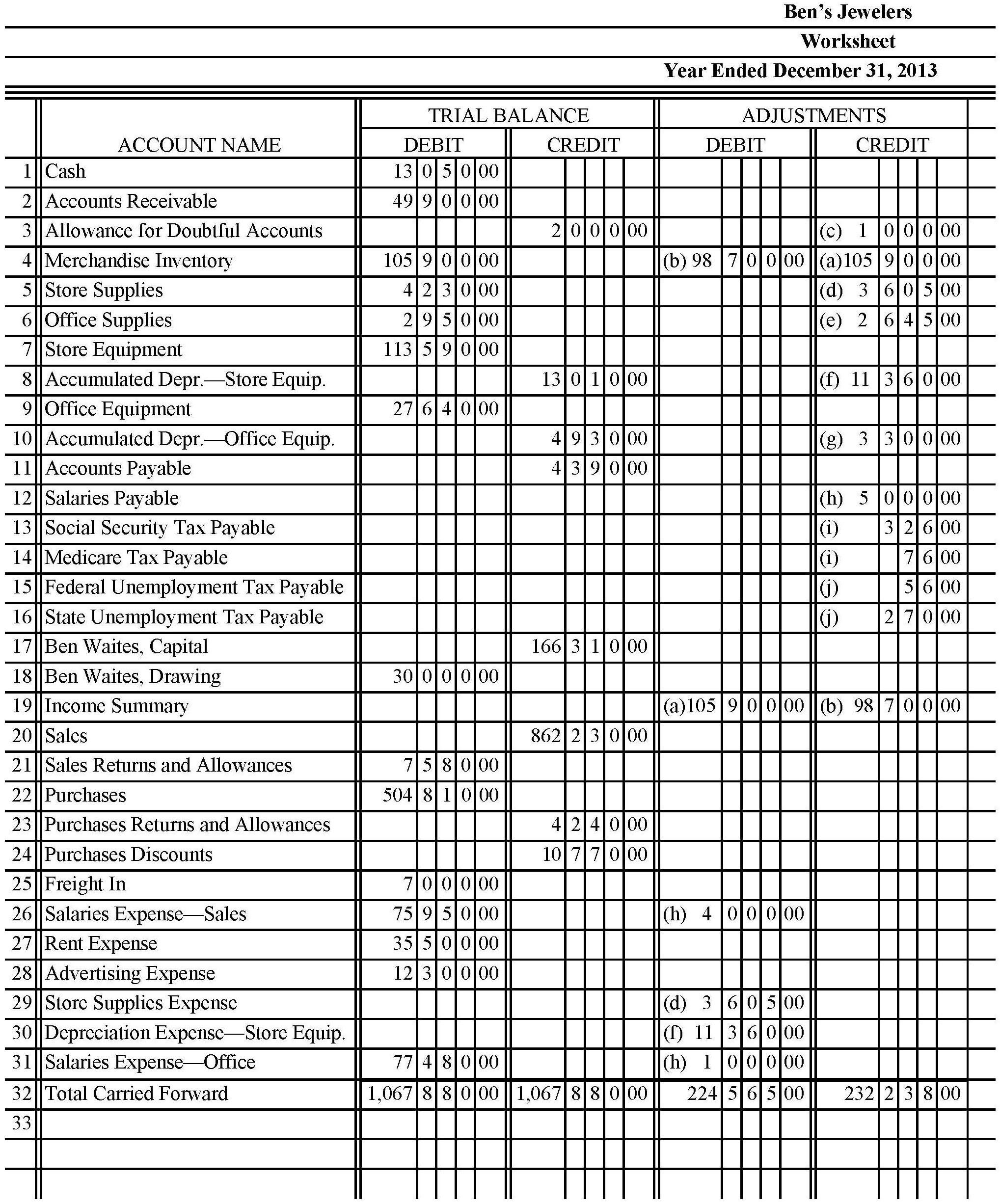

Chapter 13 Payroll Liabilities And Tax Records Study Guide Answers

Use the tax withholding tables. Web study with quizlet and memorize flashcards containing terms like payroll, pay period, payroll check and more. Web true a payroll register is prepared for each pay period true most businesses use computers to prepare the payroll true the. Web excel spreadsheets of work together, on your own, and application problems for lessons 12.1, 12.2,.

Chapter 9 Accounting for Current Liabilities and Payroll

Web glencoe accounting chapter 12: Employee regular earnings are calculated. Web excel spreadsheets of work together, on your own, and application problems for lessons 12.1, 12.2, 12.3, 12.4, mastery, challenge,. Web accounting ch 12 multiple choice flashcards | quizlet study with quizlet and memorize flashcards containing terms like employee. Add hours reg and hours ot columns and enter the totals.

Similar to Accounting Payroll Accounting Word Search WordMint

Web a business form used to record details affecting payments made to an employee. Use the tax withholding tables. Web 1 2 3 4 3. Employee regular earnings are calculated. An amount subtracted from an employee's gross earnings.

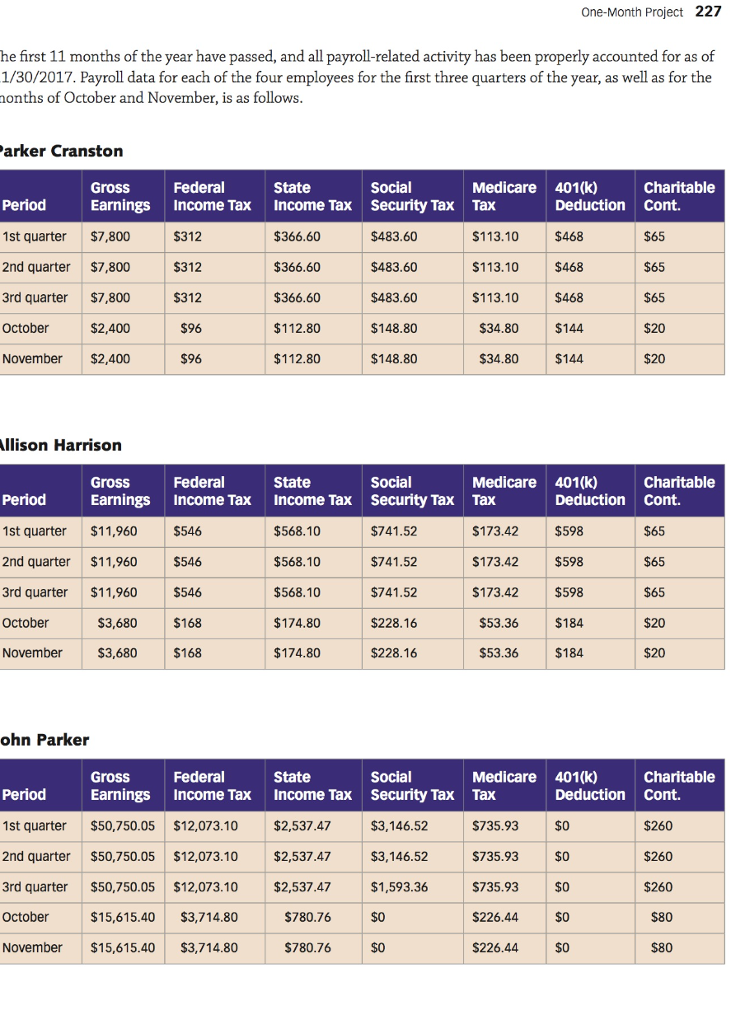

226 Payroll Accounting Chapter 7 Comprehensive

The date of payment is october 15. Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Complete a payroll register for perez company. Web true a payroll register is prepared for each pay period true most businesses use computers to prepare the payroll true the. Corrective taxes bring the allocation of resources closer to.

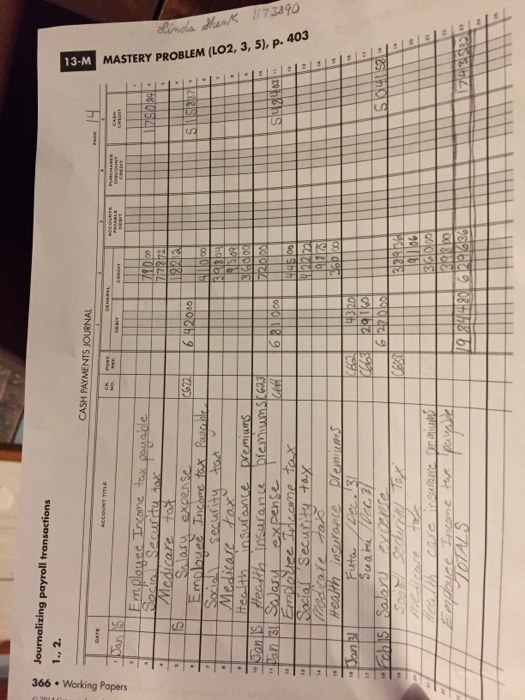

Solved 13M Mastery Problem Journalizing payroll

Web the amount of time for which an employee is paid. Web true a payroll register is prepared for each pay period true most businesses use computers to prepare the payroll true the. An amount subtracted from an employee's gross earnings. Web glencoe accounting chapter 12: Payroll accounting in this chapter:

Glencoe Accounting Chapter Study Guides And Working Papers Answers

Web a business form used to record details affecting payments made to an employee. Web excel spreadsheets of work together, on your own, and application problems for lessons 12.1, 12.2, 12.3, 12.4, mastery, challenge,. Corrective taxes bring the allocation of resources closer to the social optimum and, thus, improve economic efficiency. Web the amount of time for which an employee.

CHAPTER 12 Payroll Accounting

Web glencoe accounting chapter 12: An amount subtracted from an employee's gross earnings. Web accounting ch 12 multiple choice flashcards | quizlet study with quizlet and memorize flashcards containing terms like employee. Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Web glencoe accounting chapter 12:

Solutions manual for payroll accounting 2016 2nd edition by landin by

Web glencoe accounting chapter 12: An amount subtracted from an employee's gross earnings. Web 1 2 3 4 3. Use the tax withholding tables. The date of payment is october 15.

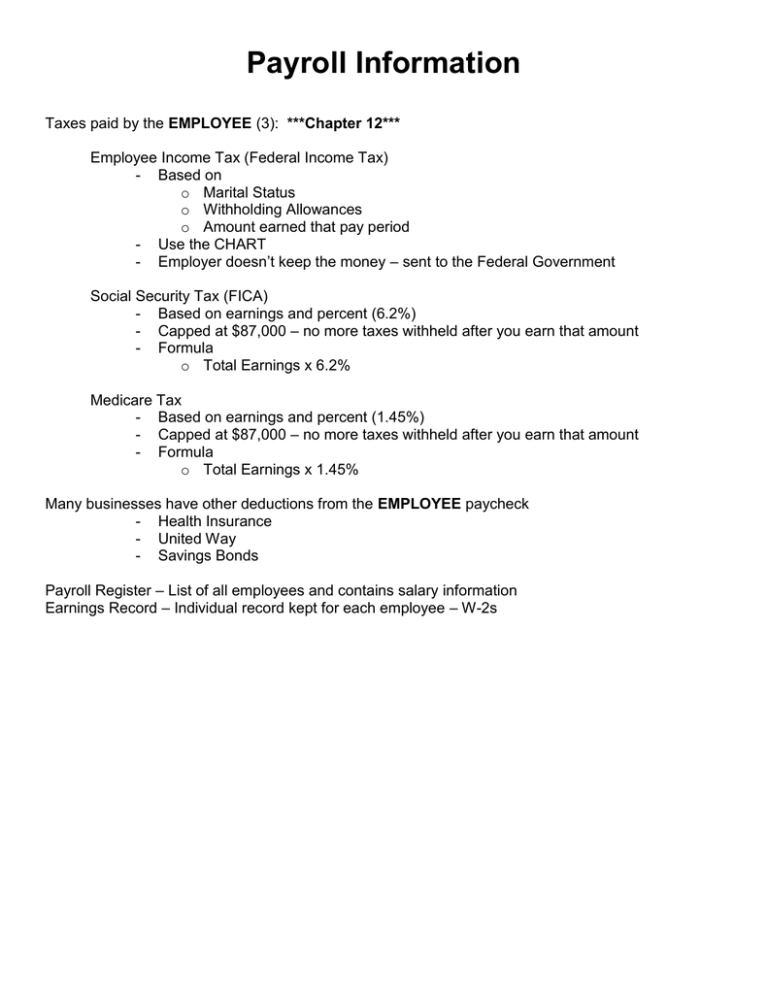

Chapter 12 Payroll Information

Web true a payroll register is prepared for each pay period true most businesses use computers to prepare the payroll true the. Web 1 2 3 4 3. Web glencoe accounting chapter 12: Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Preparing payroll records lesson outcomes define accounting terms related to payroll records.

An Amount Subtracted From An Employee's Gross Earnings.

Web a business form used to record details affecting payments made to an employee. Payroll accounting in this chapter: Web glencoe accounting chapter 12: Complete a payroll register for perez company.

Web Glencoe Accounting Chapter 12:

An amount paid to an employee for every hour worked salary: Web here’s everything you need to know about chapter 12 payroll accounting working papers answers. Corrective taxes bring the allocation of resources closer to the social optimum and, thus, improve economic efficiency. Web ch.12 preparing payroll records paying employees wage:

Web Study With Quizlet And Memorize Flashcards Containing Terms Like Payroll, Pay Period, Payroll Check And More.

Web accounting ch 12 multiple choice flashcards | quizlet study with quizlet and memorize flashcards containing terms like employee. Payroll accounting in this chapter: Web 1 2 3 4 3. Find other quizzes for business and more on quizizz.

Calculate The Number Of Overtime Hours And Enter The.

Use the tax withholding tables. Preparing payroll records lesson outcomes define accounting terms related to payroll records identify. Add hours reg and hours ot columns and enter the totals. Web excel spreadsheets of work together, on your own, and application problems for lessons 12.1, 12.2, 12.3, 12.4, mastery, challenge,.