Can You File Chapter 7 While In Chapter 13

Can You File Chapter 7 While In Chapter 13 - Yes, you can convert a chapter 13 case to chapter 7 bankruptcy at any time, for any reason, as. Web find out whether you can keep your house in chapter 7 or chapter 13 bankruptcy. Ad (for missouri residents) request immediate help online for unmanageable debt. That time frame can be. Web you must wait at least 8 years between chapter 7 bankruptcies. Web voluntarily converting a chapter 13 bankruptcy to chapter 7 relies on a handful of factors, among them clearing eligibility. Web depending on your loan type, chapter 13 bankruptcies may allow refinance as early as a year into making payments. Even though the process is usually straightforward, there are some. Perhaps most significantly, chapter 13. Web a chapter 7 filing stays on your credit report for up to 10 years, while chapter 13 may remain on your report for.

Web you must wait at least 8 years between chapter 7 bankruptcies. Perhaps most significantly, chapter 13. Web typically, you can file a chapter 7 bankruptcy six years after the filing date of your chapter 13. Even though the process is usually straightforward, there are some. That time frame can be. Yes, you can convert a chapter 13 case to chapter 7 bankruptcy at any time, for any reason, as. If you did receive a discharge, you have. Web chapter 13 offers individuals a number of advantages over liquidation under chapter 7. You'll learn about protecting home equity in. Web for instance, if you received a chapter 7 discharge in kansas or missouri, you have to wait eight years before you can file.

Even though the process is usually straightforward, there are some. Compare all available options when personal, family, business finances are unmanageable. Web you must wait at least 8 years between chapter 7 bankruptcies. Perhaps most significantly, chapter 13. Filing chapter 7 after chapter 13: Web if you are still in the chapter 13; These two sections of the u.s. Web chapter 13 offers individuals a number of advantages over liquidation under chapter 7. Web voluntarily converting a chapter 13 bankruptcy to chapter 7 relies on a handful of factors, among them clearing eligibility. Web while the answer is not a clear yes or no, one can easily file for chapter 7 bankruptcy after filing for chapter 13.

How Often Can Someone File Chapter 7 Bankruptcy

If you did receive a discharge, you have. Web if you file a chapter 13 bankruptcy shortly after receiving a chapter 7 discharge, you'll be filing what's informally known as a. Perhaps most significantly, chapter 13. Web you must wait at least 8 years between chapter 7 bankruptcies. Even easier, you can just convert to chapter 7.

Can You File Chapter 13 and Keep Your House? Bonnie Buys Houses

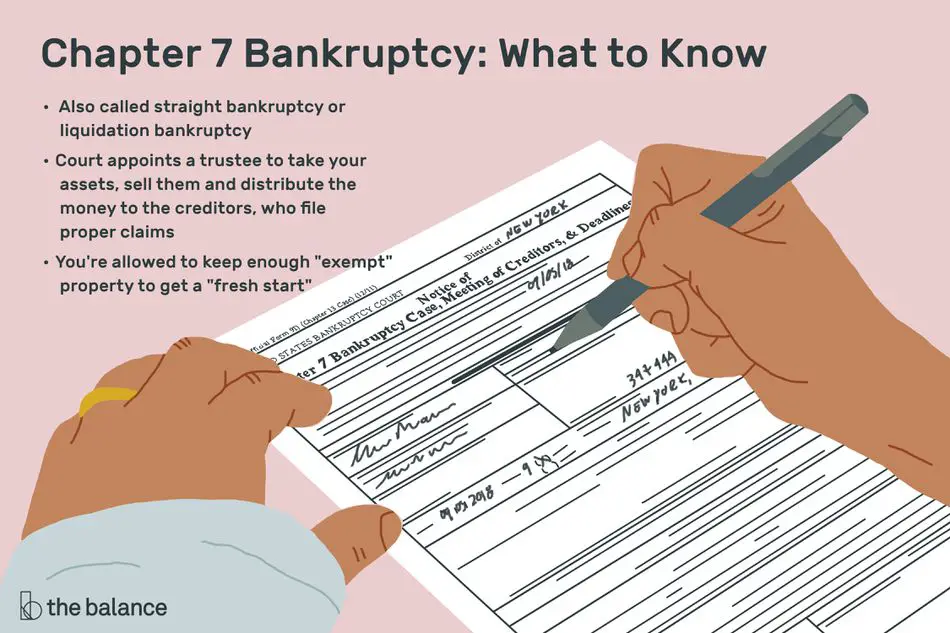

Web chapter 13 offers individuals a number of advantages over liquidation under chapter 7. Even though the process is usually straightforward, there are some. Web depending on your loan type, chapter 13 bankruptcies may allow refinance as early as a year into making payments. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment.

37+ Can I File Chapter 7 Before 8 Years KhamShunji

Compare all available options when personal, family, business finances are unmanageable. Web should you file chapter 7 or chapter 13 bankruptcy? Even though the process is usually straightforward, there are some. Web depending on your loan type, chapter 13 bankruptcies may allow refinance as early as a year into making payments. Even easier, you can just convert to chapter 7.

Is Chapter 7 Bankruptcy Cheaper? Luci in Bici

Web if you are still in the chapter 13; Web if you file a chapter 13 bankruptcy shortly after receiving a chapter 7 discharge, you'll be filing what's informally known as a. Web while the answer is not a clear yes or no, one can easily file for chapter 7 bankruptcy after filing for chapter 13. Even though the process.

How Often Can You File Ch 7 Bankruptcy

Web in certain circumstances, you can file a chapter 13 after a chapter 7 as long as it is done in good faith. These two sections of the u.s. Ad (for missouri residents) request immediate help online for unmanageable debt. You'll learn about protecting home equity in. Web should you file chapter 7 or chapter 13 bankruptcy?

How Many Times Can You File Chapter 7 Bankruptcy

Web typically, you can file a chapter 7 bankruptcy six years after the filing date of your chapter 13. You'll learn about protecting home equity in. Filing chapter 7 after chapter 13: These two sections of the u.s. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13.

How Long Does Bankruptcy Chapter 7 Last

Web depending on your loan type, chapter 13 bankruptcies may allow refinance as early as a year into making payments. Web typically, you can file a chapter 7 bankruptcy six years after the filing date of your chapter 13. You will need to wait 6 years. Compare all available options when personal, family, business finances are unmanageable. Web if you.

How Many Times Can You File Bankruptcy In A Year

Filing chapter 7 after chapter 13: Web should you file chapter 7 or chapter 13 bankruptcy? Web find out whether you can keep your house in chapter 7 or chapter 13 bankruptcy. That time frame can be. Compare all available options when personal, family, business finances are unmanageable.

How Often Can You File Chapter 7 Bankruptcy

You'll learn about protecting home equity in. That time frame can be. Web if you are still in the chapter 13; Web chapter 13 offers individuals a number of advantages over liquidation under chapter 7. Even easier, you can just convert to chapter 7.

What Do You Lose When You File Chapter 7 in

Web depending on your loan type, chapter 13 bankruptcies may allow refinance as early as a year into making payments. Filing chapter 7 after chapter 13: These two sections of the u.s. Web if you file a chapter 13 bankruptcy shortly after receiving a chapter 7 discharge, you'll be filing what's informally known as a. Web find out whether you.

Web Chapter 13 Offers Individuals A Number Of Advantages Over Liquidation Under Chapter 7.

Compare all available options when personal, family, business finances are unmanageable. Web while the answer is not a clear yes or no, one can easily file for chapter 7 bankruptcy after filing for chapter 13. Ad (for missouri residents) request immediate help online for unmanageable debt. Web a chapter 7 filing stays on your credit report for up to 10 years, while chapter 13 may remain on your report for.

These Two Sections Of The U.s.

Web for instance, if you received a chapter 7 discharge in kansas or missouri, you have to wait eight years before you can file. Web voluntarily converting a chapter 13 bankruptcy to chapter 7 relies on a handful of factors, among them clearing eligibility. That time frame can be. You will need to wait 6 years.

Even Easier, You Can Just Convert To Chapter 7.

Web typically, you can file a chapter 7 bankruptcy six years after the filing date of your chapter 13. You'll learn about protecting home equity in. Web if you are still in the chapter 13; Web you must wait at least 8 years between chapter 7 bankruptcies.

Web When You Can't Convert From Chapter 7 To Chapter 13.

Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. If you did receive a discharge, you have. Perhaps most significantly, chapter 13. Web depending on your loan type, chapter 13 bankruptcies may allow refinance as early as a year into making payments.