Can An S Corp File Chapter 7

Can An S Corp File Chapter 7 - In some cases, you might not be able to continue operating your business when you file for chapter 7. When these companies file for chapter 7, it becomes the bankruptcy trustee's responsibility to sell off the business's. To be an s corporation beginning with its first tax year, the corporation must file form 2553 during the period that begins january 7. Note that even if the business bankruptcy. Hello kelli, i'm not a bankruptcy attorney. You must have unanimous shareholder consent. Web chapter 7 bankruptcy for small businesses can you keep your business if you file for chapter 7 bankruptcy? Chapter 7 eligibility to qualify for relief under chapter 7 of the bankruptcy code, the debtor may be. Web a corporation or llc has two options for filing bankruptcy: Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code.

Chapter 7 eligibility to qualify for relief under chapter 7 of the bankruptcy code, the debtor may be. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web chapter 7 bankruptcy for small businesses can you keep your business if you file for chapter 7 bankruptcy? Court for recognition of schemes of arrangement under the offshore debt restructuring for hong kong and the british virgin islands. To be an s corporation beginning with its first tax year, the corporation must file form 2553 during the period that begins january 7. Note that even if the business bankruptcy. How chapter 7 could benefit an llc or corporation, and. In some cases, you might not be able to continue operating your business when you file for chapter 7. It is available to individuals who cannot make regular, monthly, payments toward their debts. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation.

For additional tax information on bankruptcy, refer to publication 908, bankruptcy tax guide and publication 5082, what you should know about chapter. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Even though an s corp cannot be owned by an llc, an s corp can own an llc. When these companies file for chapter 7, it becomes the bankruptcy trustee's responsibility to sell off the business's. In some cases, you might not be able to continue operating your business when you file for chapter 7. Although business entities can file a chapter 7 corporate bankruptcy, they cannot receive a discharge. Web you'll be able to discharge all qualifying debt—both personal and business—by filing a chapter 7 bankruptcy in your own name. Web how a business can benefit from filing for chapter 7 bankruptcy. The risks associated with a business chapter 7 filing. Learn more about s corp vs c corp election to get started.

How Long Does Bankruptcy Chapter 7 Last

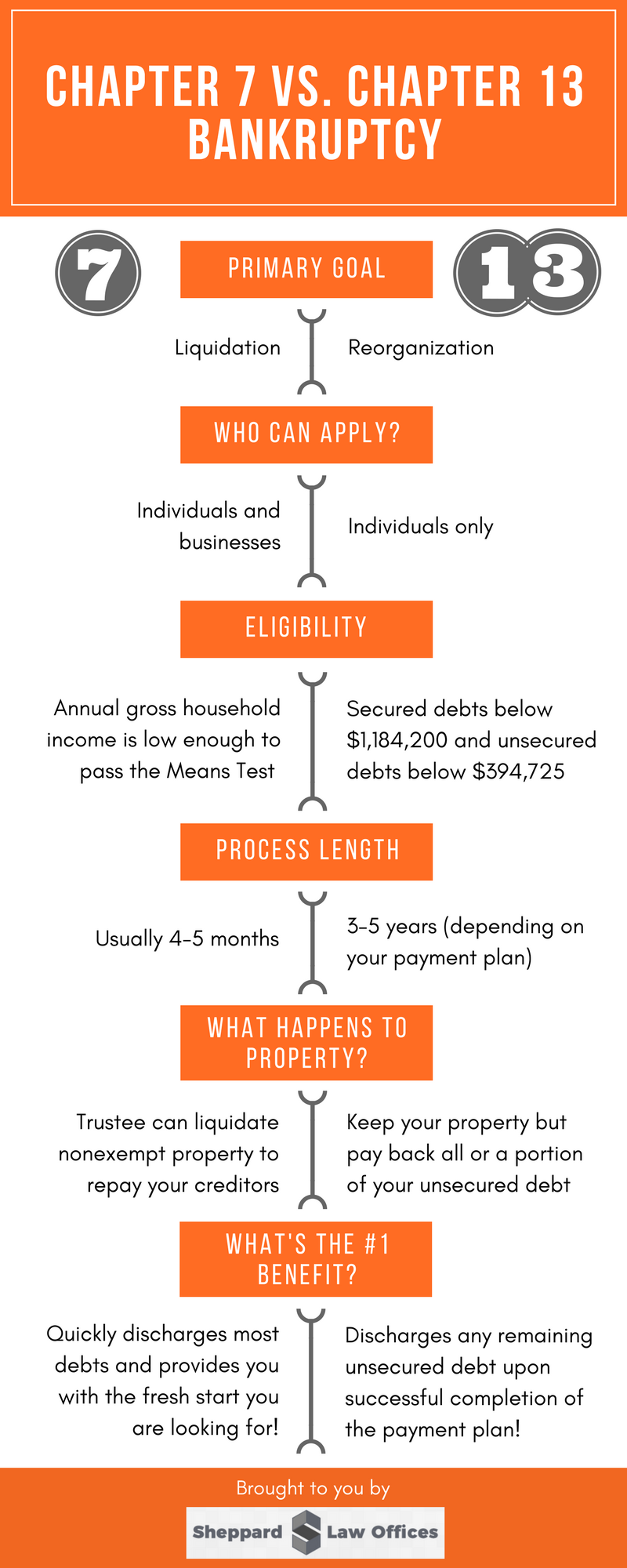

Web liquidation under chapter 7 is a common form of bankruptcy. Web a calendar year small business corporation begins its first tax year on january 7. Web an llc can act as an investor in a corporation just like an individual would, but s corporations can only be owned by actual individuals. Web the main pros to chapter 7 are.

(x 3)(x 4)(x 6)(x 7)=1120 E START サーチ

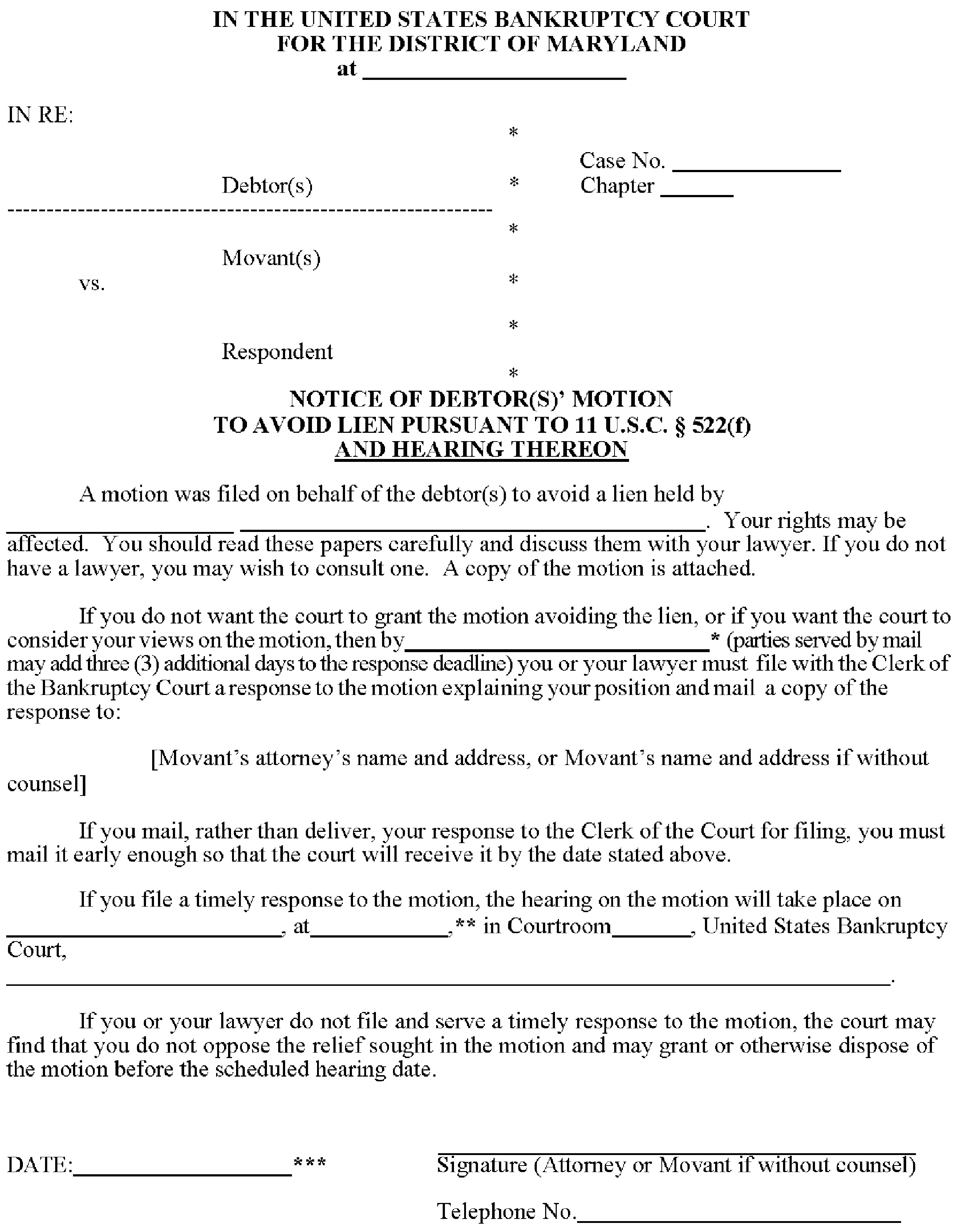

Court for recognition of schemes of arrangement under the offshore debt restructuring for hong kong and the british virgin islands. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. The risks associated with a business chapter 7 filing. Web you'll be able to discharge all qualifying debt—both personal and business—by filing.

22+ Can I File Chapter 7 MaeghanEllisa

Web what happens in a chapter 7 business bankruptcy. To be an s corporation beginning with its first tax year, the corporation must file form 2553 during the period that begins january 7. When these companies file for chapter 7, it becomes the bankruptcy trustee's responsibility to sell off the business's. Chapter 7 provides relief to debtors regardless of the.

Can an Scorp Own a SingleMember LLC? Northwest Registered Agent

The main cons to chapter 7. Note that even if the business bankruptcy. Web the main pros to chapter 7 are that you can receive immediate relief from collection actions (due to the automatic stay) as well as permanent relief from debts if your bankruptcy is discharged. Web chapter 7 bankruptcy for small businesses can you keep your business if.

How Often Can Someone File Chapter 7 Bankruptcy

Web can i file chapter 7 for an s corporation that has no assets and no money, but owes 2004 (california) minimum tax of $800 plus penalties? To qualify for s corporation status, the corporation must meet the following requirements: Web can a corporation or llc do that? Note that even if the business bankruptcy. If you have more business.

Filing S Corp Taxes 101 — How to File S Corp Taxes TRUiC

Web chapter 7 bankruptcy for small businesses can you keep your business if you file for chapter 7 bankruptcy? For additional tax information on bankruptcy, refer to publication 908, bankruptcy tax guide and publication 5082, what you should know about chapter. Web however, an s corporation doesn’t pay any tax to the irs. Even though an s corp cannot be.

How To Create An LLC With An SCorp S Corp Formation S Corp Tax

Nonetheless, chapter 7 can still offer some advantages to a struggling corporation. When these companies file for chapter 7, it becomes the bankruptcy trustee's responsibility to sell off the business's. The risks associated with a business chapter 7 filing. Web accordingly, potential debtors should realize that the filing of a petition under chapter 7 may result in the loss of.

How Do I Claim Employee Retention Credit For 2020?

Hello kelli, i'm not a bankruptcy attorney. Chapter 7 liquidation, or chapter 11 reorganization. If your business is a corporation or limited liability company (llc), chapter 7 bankruptcy provides a way to close down and liquidate the company transparently. Whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. How chapter 7 could benefit an llc.

Md Chapter 7 Bankruptcy Forms Form Resume Examples QJ9ewRAVmy

Web evergrande said in a filing on friday that it will ask the u.s. Individuals may also file under chapter 7 or chapter 11. Hello kelli, i'm not a bankruptcy attorney. A corporation does not receive a discharge but the business can shut down, turn over its records to a bankruptcy trustee and not have to deal with creditors, pending.

How To File Bankruptcy Chapter 7 Yourself In Nj

Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. In a business chapter 7 bankruptcy, the business is closed, all assets are liquidated by the bankruptcy trustee, and the proceeds from the business assets are paid out to the business’s. It seems to me it would cost less to pay the.

We Also Explain Why Winding Down A Corporation Or.

Web you'll be able to discharge all qualifying debt—both personal and business—by filing a chapter 7 bankruptcy in your own name. The risks associated with a business chapter 7 filing. Web an llc can act as an investor in a corporation just like an individual would, but s corporations can only be owned by actual individuals. Individuals may also file under chapter 7 or chapter 11.

If Your Business Is A Corporation Or Limited Liability Company (Llc), Chapter 7 Bankruptcy Provides A Way To Close Down And Liquidate The Company Transparently.

Web the chapter 11 filing would cover rite aid’s more than $3.3 billion debt load and pending legal allegations that it oversupplied prescription painkillers, the newspaper reported. Court for recognition of schemes of arrangement under the offshore debt restructuring for hong kong and the british virgin islands. It seems to me it would cost less to pay the tax and terminate the corporation. To qualify for s corporation status, the corporation must meet the following requirements:

When These Companies File For Chapter 7, It Becomes The Bankruptcy Trustee's Responsibility To Sell Off The Business's.

It is available to individuals who cannot make regular, monthly, payments toward their debts. Chapter 7 liquidation, or chapter 11 reorganization. So unless you could protect your holdings with a wildcard. If you have more business debt that personal debt, you likely won't need to worry about how much income you make—you won't need to pass the chapter 7.

Note That Even If The Business Bankruptcy.

Chapter 7 eligibility to qualify for relief under chapter 7 of the bankruptcy code, the debtor may be. Web what happens in a chapter 7 business bankruptcy. Nonetheless, chapter 7 can still offer some advantages to a struggling corporation. In a business chapter 7 bankruptcy, the business is closed, all assets are liquidated by the bankruptcy trustee, and the proceeds from the business assets are paid out to the business’s.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)