Accounting Chapter 13 Test A Answers

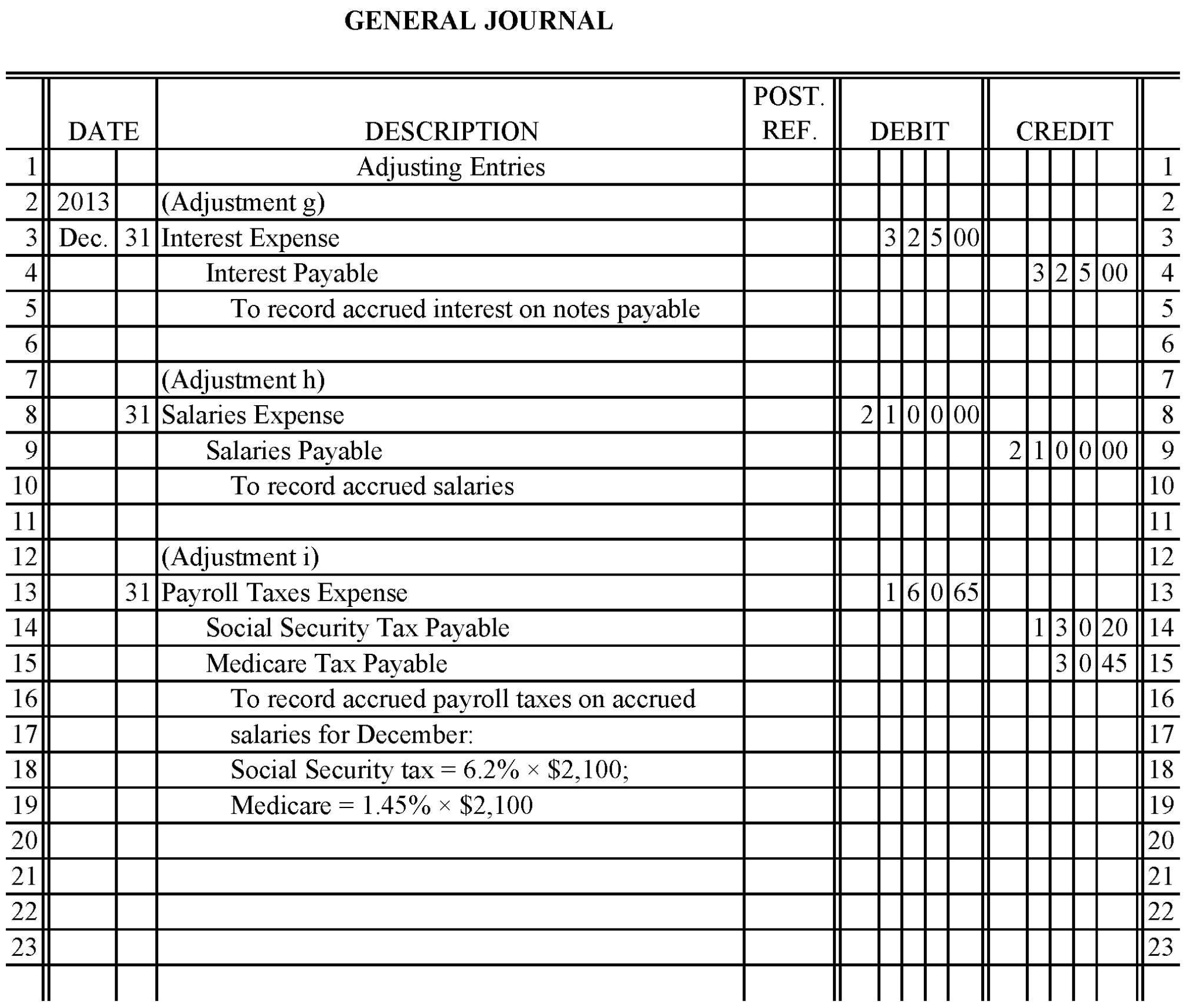

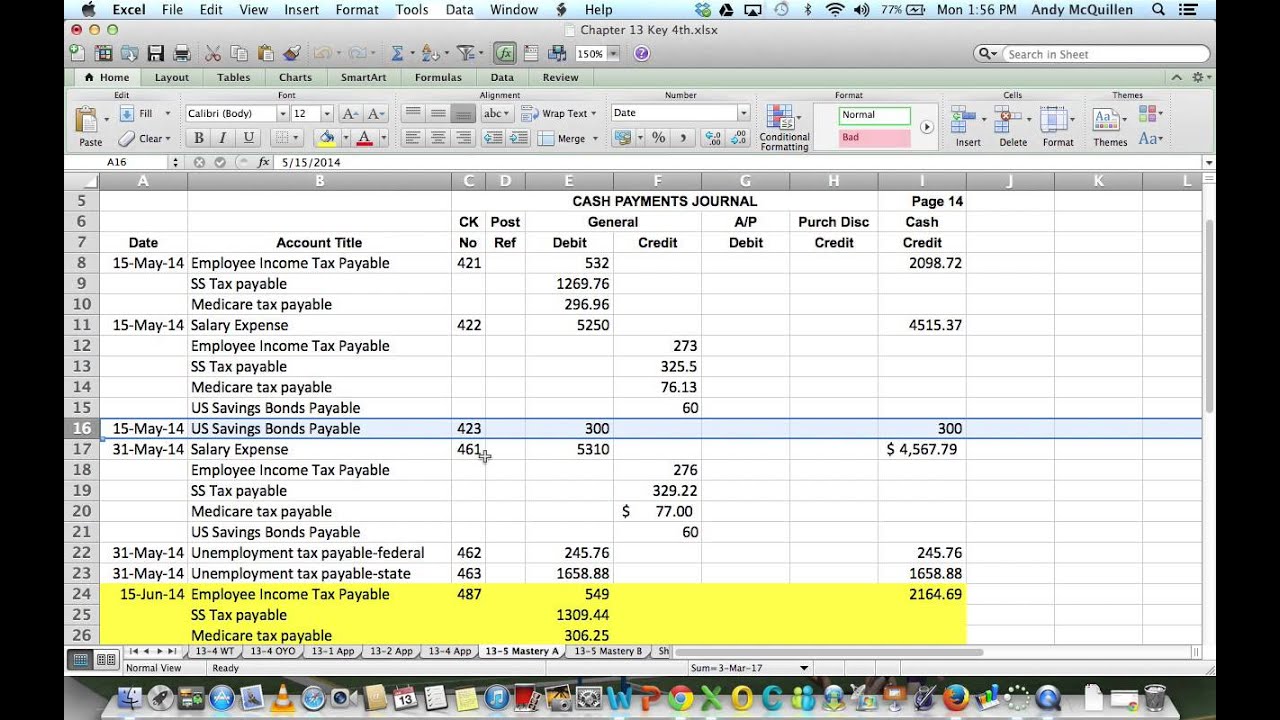

Accounting Chapter 13 Test A Answers - Web three tools of financial statement analysis are: Determination of gain or loss, basis considerations, and nontaxable exchanges 1473. Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. Ifrs questions are available at the end of this chapter. Web test bank chapter 13 property transactions: Learn vocabulary, terms, and more with flashcards, games, and other answers to cengage accounting homework answers to cengage accounting homework. The form that is prepared and sent with the employer's check to. Journalizing payroll transactions 1o2, 3,5. A credit to notes payable for $2,855. This problem has been solved:

A debit to cash for $2,855. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. A credit to notes payable for $2,855. Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. Our solutions are written by chegg experts so you can be assured. (d) transferred out to next department (100%) 55,000 normal lost. Web chapter 13 current liabilities and contingencies. Of the following items, the only one which should not be classified as a current liability is a. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Web chapter 13 solution for intermediate accounting by donald e.

Web chapter 13 solution for intermediate accounting by donald e. The form that is prepared and sent with the employer's check to. The employees payroll taxes are operating expenses of the business. Determination of gain or loss, basis considerations, and nontaxable exchanges 1473. Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. A debit to interest expense for $145. Web 13th edition solutions cost accounting (13th edition) % we have solutions for your book! Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. Web chapter 13 mastery problem accounting | login pages finder. Comparison of a company financial condition and performance across time.

Accounts Receivable Test Prep Practice Tests

Determination of gain or loss, basis considerations, and nontaxable exchanges 1473. Click the card to flip 👆 salaries expense is debited click the card to flip 👆 1 / 30 flashcards learn test match created. Web chapter 13 solution for intermediate accounting by donald e. Web three tools of financial statement analysis are: Please check your connection and try again.

Accounting Chapter 12 Study Guide True And False Study Poster

Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. The journal entry to record the insurance of the note will include a. A debit to cash for $2,855. Click the card to flip 👆. Realized.

Chapter 1 Test Bank Financial Accounting MIS101 DU StuDocu

Click the card to flip 👆. Web chapter 13 mastery problem accounting | login pages finder. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. This problem has been solved: Determination of gain or loss, basis considerations, and nontaxable exchanges 1473.

Solved Test Chapter 13 Test O C. 2

Click the card to flip 👆 salaries expense is debited click the card to flip 👆 1 / 30 flashcards learn test match created. Web study with quizlet and memorize flashcards containing terms like the ss tax is paid by both the employer and employees., the fed. Warfield (16e) chapter 13 current liabilities and contingencies skip to document ask ai.

Glencoe Accounting Chapter 10 Answer Key Gamers Smart

Of the following items, the only one which should not be classified as a current liability is a. Web chapter 13 highlights we're unable to load study guides on this page. Ifrs questions are available at the end of this chapter. Web access introduction to managerial accounting 6th edition chapter 13 solutions now. Determination of gain or loss, basis considerations,.

Ch03 Summary Financial Accounting IFRS, 3rd Edition CHAPTER 3

The journal entry to record the insurance of the note will include a. Ifrs questions are available at the end of this chapter. Click the card to flip 👆 true 1 / 25 flashcards created by. This problem has been solved: Web 13th edition solutions cost accounting (13th edition) % we have solutions for your book!

135 Mastery Accounting 1 YouTube

Web chapter 13 mastery problem accounting | login pages finder. Web chapter 13 solution for intermediate accounting by donald e. The journal entry to record the insurance of the note will include a. Comparison of a company financial condition and performance across time. Realized gain or loss is

Accounting Chapter 10 Study Guide Answers Part 3 Study Poster

Web chapter 13 mastery problem accounting | login pages finder. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. Unemployment tax rate is greater than the state unemployment. The form that is prepared and sent with the employer's check to. Click the.

UpWork (oDesk) & Elance Accounting Principles Test Question & Answers

Web access introduction to managerial accounting 6th edition chapter 13 solutions now. Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee. Web test bank chapter 13 property transactions: A debit to interest expense for $145..

PPT Accounting Chapter 11 Test Review PowerPoint Presentation, free

Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. Web chapter 13 mastery problem accounting | login pages finder. Web study with quizlet and memorize flashcards containing terms like the ss tax is paid by both the employer and employees., the fed..

Realized Gain Or Loss Is

Warfield (16e) chapter 13 current liabilities and contingencies skip to document ask ai Web chapter 13 solution for intermediate accounting by donald e. Unemployment tax rate is greater than the state unemployment. Web false the transaction to record employer payroll taxes expense is journalized at the end of the quarter false each employer is require day law to periodically report the payroll taxes withheld form employee.

Of The Following Items, The Only One Which Should Not Be Classified As A Current Liability Is A.

Web test bank chapter 13 property transactions: (d) transferred out to next department (100%) 55,000 normal lost. Web three tools of financial statement analysis are: Determination of gain or loss, basis considerations, and nontaxable exchanges 1473.

Web Access Introduction To Managerial Accounting 6Th Edition Chapter 13 Solutions Now.

The employees payroll taxes are operating expenses of the business. Ifrs questions are available at the end of this chapter. Our solutions are written by chegg experts so you can be assured. Web 13th edition solutions cost accounting (13th edition) % we have solutions for your book!

This Problem Has Been Solved:

Click the card to flip 👆 true 1 / 25 flashcards created by. A debit to interest expense for $145. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her employee earnings record. Web the present value of the note is $2,855.