401K Loan Chapter 13 Without Permission

401K Loan Chapter 13 Without Permission - Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission. If the loan is over. Web you may be able to take a 401k loan but you will need to request permission from your chapter 13 trustee. Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. Web fact that payroll deduction for 401(k) loan repayment in chapter 13 would result in $0 for unsecured creditors is not a special. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that.

Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission. Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. The court can certainly dismiss your chapter 13 plan because you failed to. Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web there isn't any exception for 401(k) loans.

Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. The court can certainly dismiss your chapter 13 plan because you failed to. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that. Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i.

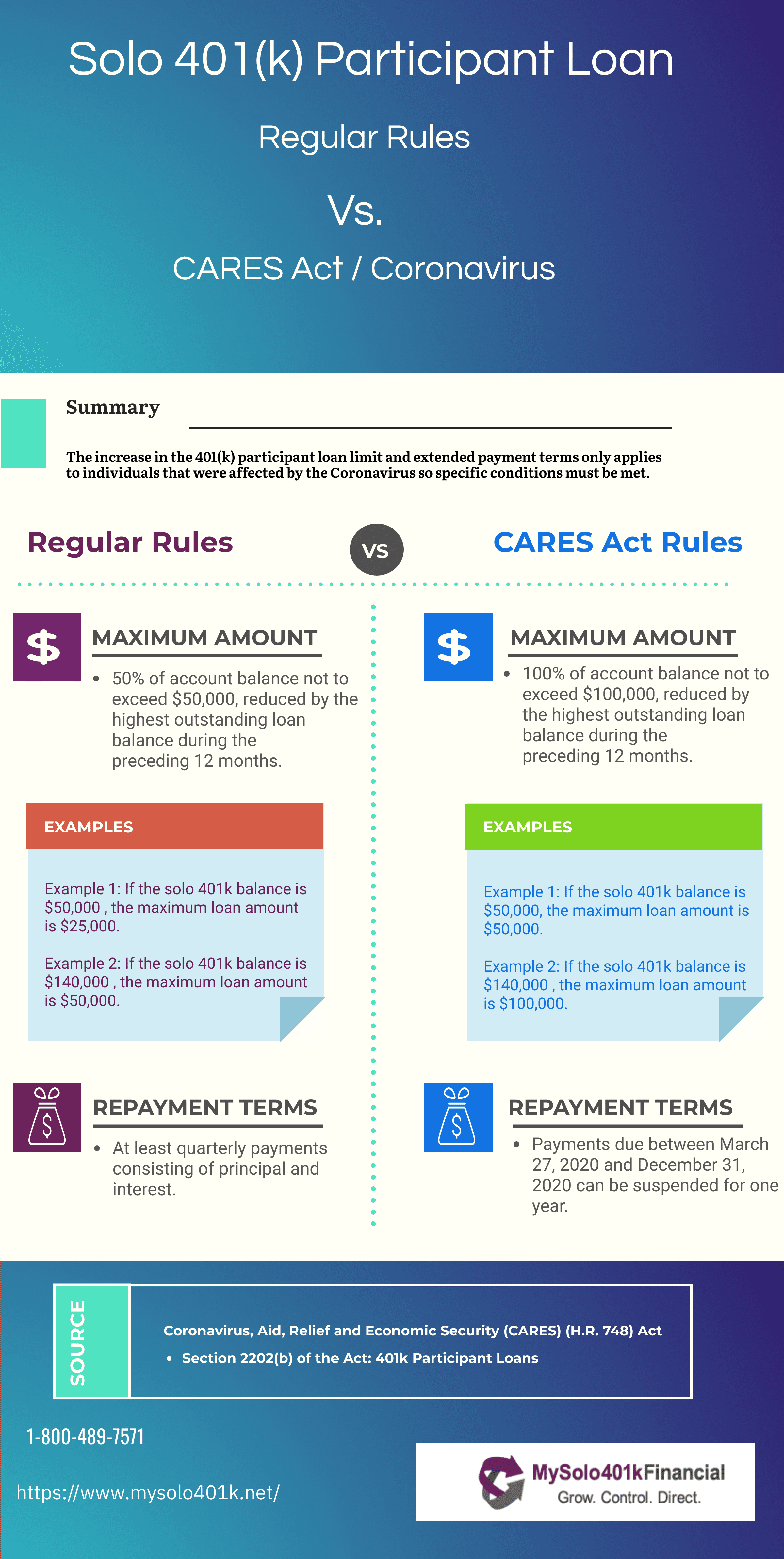

Solo 401k Loan Rules and Regulations My Solo 401k Financial

Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission. Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. The court can certainly dismiss your chapter 13 plan because you failed to. Web continuing to.

How My 401k Loan Cost Me 1 Million Dollars Is a 401k loan a good idea?

Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. Web there isn't any exception for 401(k) loans. Web fact that payroll deduction for 401(k) loan repayment in chapter 13 would result in $0 for unsecured creditors is not a special. Web you may be able to take a 401k loan.

Can I Stop Making 401k Loan Payments? Finstream.TV

Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. Web to obtain a.

How to Pay Off a 401K Loan Early 401k loan, How to get money, Paying

If the loan is over. Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. Web you may be able to take a 401k loan but you will need to request permission from your chapter 13 trustee. Web to obtain a loan from your 401 (k) while in.

Should I Take a 401k Loan for a Down Payment on a House? ⋆ Freedom Jar FIRE

Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission..

Is student loan assistance the next 401k? Bizwomen

Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web you may be able to take a 401k loan but you will need to request permission from your chapter 13 trustee. Web.

401k Loans Explained YouTube

Web you may be able to take a 401k loan but you will need to request permission from your chapter 13 trustee. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission. Web your plan's rules will also set a maximum number of loans you may have outstanding from.

What You Should Know Before You Borrow from your 401k Digest Your

Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i.

Can You Loan Money From 401k TESATEW

Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get.

Loans, withdrawal, 401k, retirement fund, finances, financial

Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. If the loan is over. Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan.

Web There Isn't Any Exception For 401(K) Loans.

If the loan is over. Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission. Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that. Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for.

Web You May Be Able To Take A 401K Loan But You Will Need To Request Permission From Your Chapter 13 Trustee.

Web fact that payroll deduction for 401(k) loan repayment in chapter 13 would result in $0 for unsecured creditors is not a special. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission.

Web Your Plan's Rules Will Also Set A Maximum Number Of Loans You May Have Outstanding From Your Plan.

Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. The court can certainly dismiss your chapter 13 plan because you failed to. Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000.